ASX ANNOUNCEMENT

30 January 2023

ASX : BEZ

December 2022 Quarterly Activities Report

HIGHLIGHTS

-

-

- Assay results received for initial round of Bekajang Project drilling included exceptional high and bonanza grade gold intercepts within the Bau Limestone, indicating a potentially very significant new deeper zone of endowment, distinct from the traditional shallow Bau Limestone – Pedawan Shale Contact (“LSC”) target.

-

-

-

- The assay results also confirmed consistent high-grade zone of polymetallic mineralisation within the LSC target zone along the northern flank of the historical Bekajang tailings dam.

-

-

-

- Gold assaying of the Jugan Drilling Program was finally completed following receipt of the results for the last two holes, JUDDH-95 & -98. Both encountered higher than average gold grades and further endorse Jugan’s stand-alone potential.

-

-

-

- Environmental Impact Assessment for the proposed Jugan pilot plant and pit was completed and lodged with Natural Resources and Environment Board of Sarawak for decision.

-

-

-

- ZJH Minerals Company Ltd continued flotation test work on Jugan mineral bulk samples in conjunction with design of the on-site pilot processing plant.

-

The Board of Besra Gold Inc (ASX: BEZ) (“Besra” or “Company”) is pleased to provide this Activities Report for the December Quarter, 2022 which accompanies the counterpart Quarterly Cash Flow Report.

BACKGROUND

Overview of Bau Gold Project

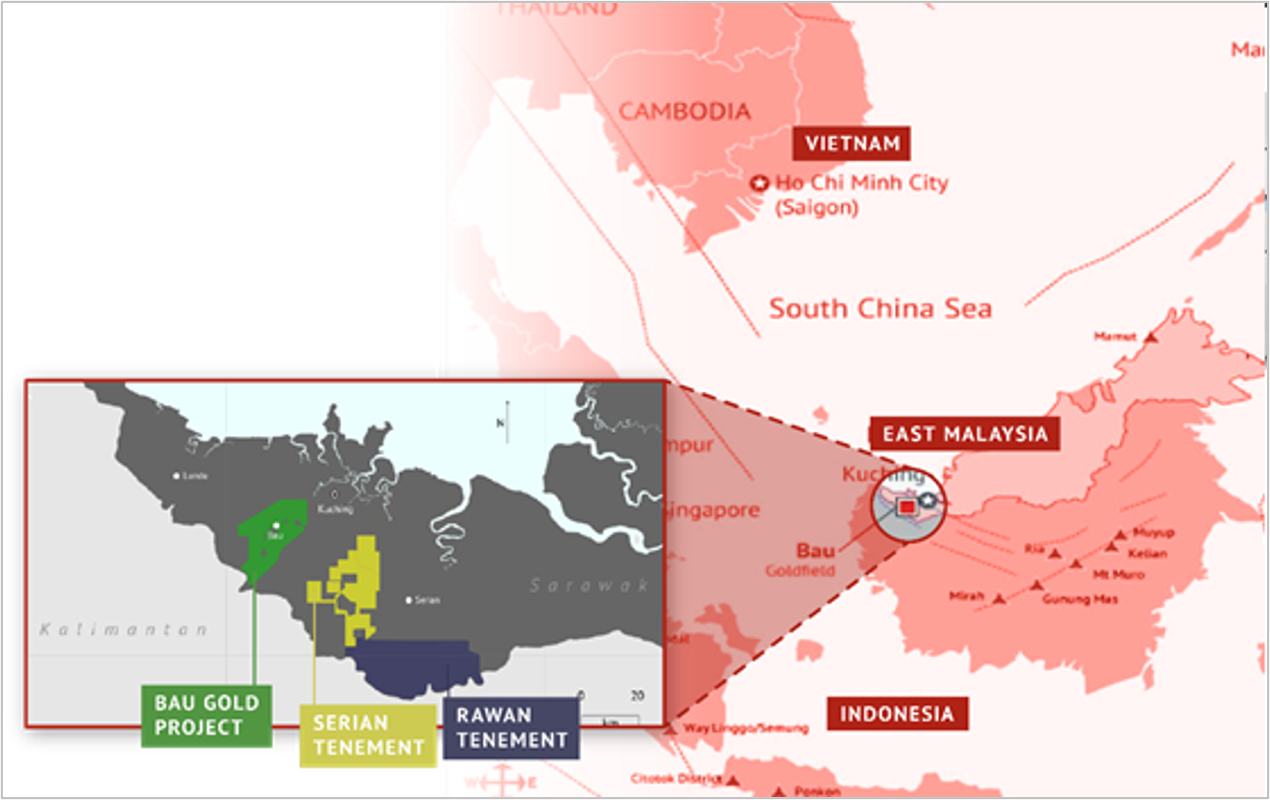

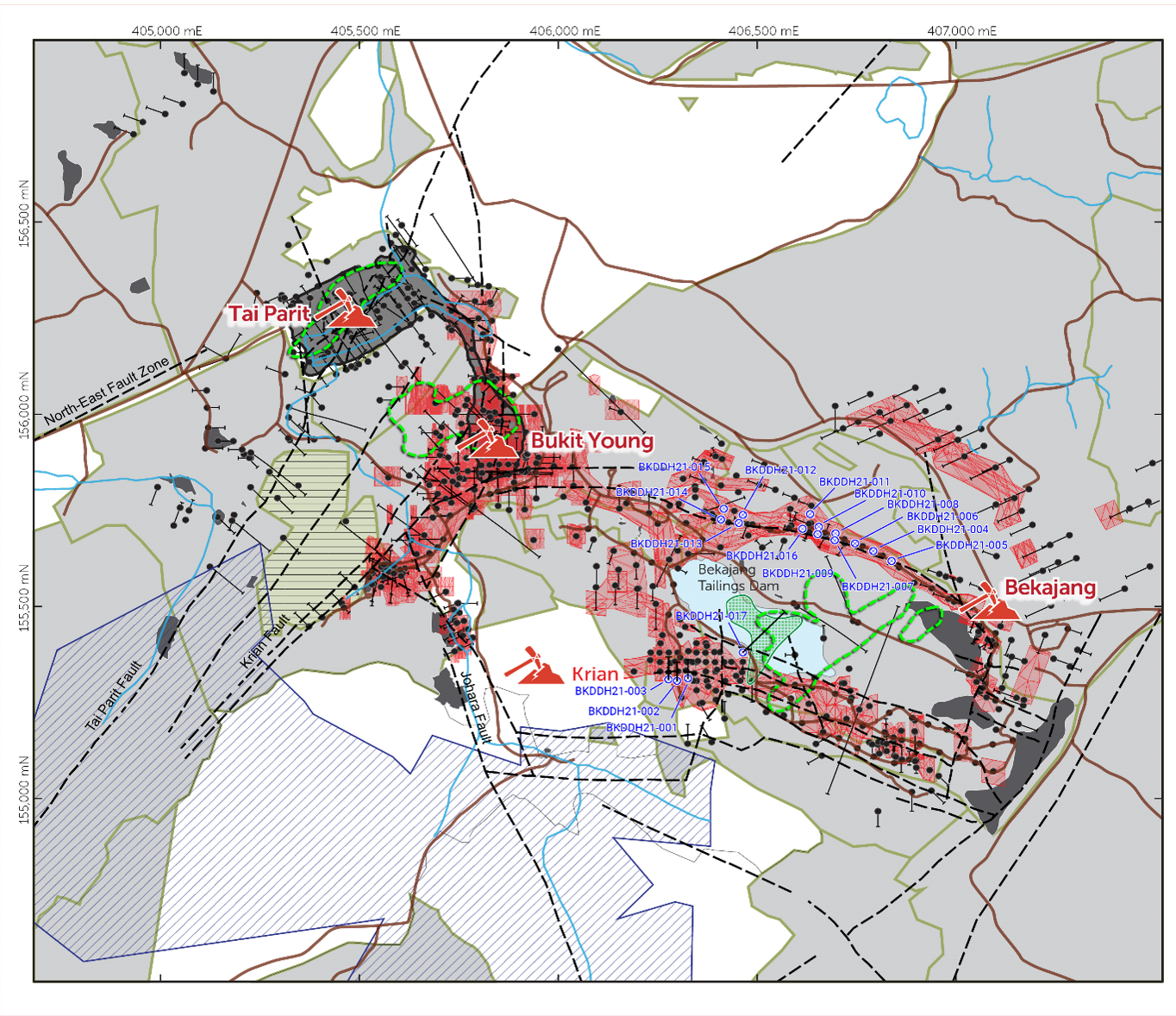

The Bau Gold Project is located 30km – 40km from Kuching, the capital city of the State of Sarawak, Malaysia, on the island of Borneo (Figure 1) and centred on the township of Bau (Figure 2).

Besra controls, directly and indirectly, a 97.8% interest (92.8% on an equity adjusted basis) of the Bau Gold Project. This project lies at the western end of an arcuate metalliferous belt extending through the island of Borneo. In Kalimantan, the Indonesian jurisdiction portion of Borneo Island, this belt is associated with significant gold mining areas including Kelian (7 Moz) and Mt Muro (3 Moz).

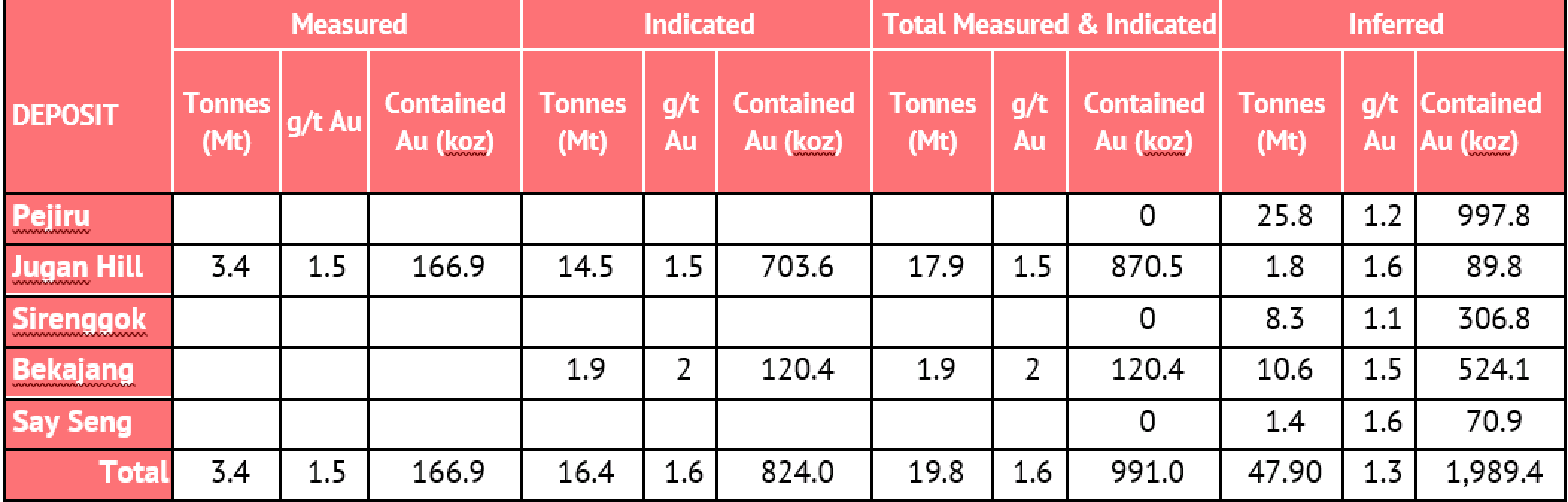

The Bau Gold Project is defined by a gold bearing mineralisation system covering approximately an 8km x 15km corridor. Within this corridor the Company has identified total Resources of 72.6Mt @ 1.4 g/t Au for 3.3Moz[1],[2] of gold, involving a number of discrete deposits (Table 1), together with a gold Exploration Target ranging between 4.9 Moz and 9.3 Moz, (on a 100% basis). The Bau Gold Project is well serviced by infrastructure including ready access to deep water ports, international airport, grid power, communications, and a multitude of service providers.

Figure 1: Location of Bau Gold Project. Inset shows tenement interests within Sarawak.

Figure 1: Location of Bau Gold Project. Inset shows tenement interests within Sarawak.

Table 1 – JORC 2012 Compliant Resources for the Bau Gold Field Project.[3]

Bekajang Project

The Bekajang Project lies along a very prospective trend that includes two historical mine sites (Figure 2). The Bukit Young Gold pit (BYG) was mined until September 1992, prior to the redevelopment of Tai Parit that, according to mine records, produced some 440,926 tonnes at a grade of 4.51 g/t Au. Tai Parit recorded production of some 700,000 oz of gold, of which approximately 213,000 oz @ 7 g/t was produced between 1991 and 1997 by Bukit Young Gold Mine Sdn Bhd, the last commercial operator.

Figure 2: Locations of the Jugan & Bekajang projects (highlighted within red boxes) on the Bau Gold Field corridor. Bau township lies adjacent to Bekajang and approximately 30km-40km from Sarawak’s capital, Kuching (refer inset).

Figure 2: Locations of the Jugan & Bekajang projects (highlighted within red boxes) on the Bau Gold Field corridor. Bau township lies adjacent to Bekajang and approximately 30km-40km from Sarawak’s capital, Kuching (refer inset).

Historical drilling provides the basis for a substantial JORC 2012 compliant Resource inventory at Bekajang, comprising:

- A Measured and Indicated Resource totalling 120.4 koz @ 2.0 g/t Au;

- An Inferred Resource of 524 koz @ 1.5 g/t Au; and

- An additional Exploration Target of 0.50 – 0.80 Moz @ 2.0 – 3.0 g/t Au, respectively.

Bekajang Drilling Program

Since August 2022 drilling was suspended until the backlog of drill core assaying was completed, and results integrated into the forward drilling program. Drilling recommenced on 29 December 2022. It involves an initial follow-up program of six fully cored holes positioned to delineate the spatial extent of the interval containing bonanza grade gold intercepted in BKDDH-27[4]. The initial Bekajang drilling program involved a total of 21 fully cored drill holes (BKDDH-12 to -30, inclusive), totalling 1,402m.

Figure 3: Location of the prospective Bekajang – Bukit Young – Tai Parit trend showing Resource wire-frames (in puce) and the current Bekajang drilling hole locations (blue annotation). Dashed green outline represents interpreted footprint of intrusive body at depth beneath the Bekajang tailings dam, based on DIGHEM anomalies. Detailed illustration of the area contained within the purple rectangle is shown as Figure 4.

Figure 3: Location of the prospective Bekajang – Bukit Young – Tai Parit trend showing Resource wire-frames (in puce) and the current Bekajang drilling hole locations (blue annotation). Dashed green outline represents interpreted footprint of intrusive body at depth beneath the Bekajang tailings dam, based on DIGHEM anomalies. Detailed illustration of the area contained within the purple rectangle is shown as Figure 4.

Assay Results

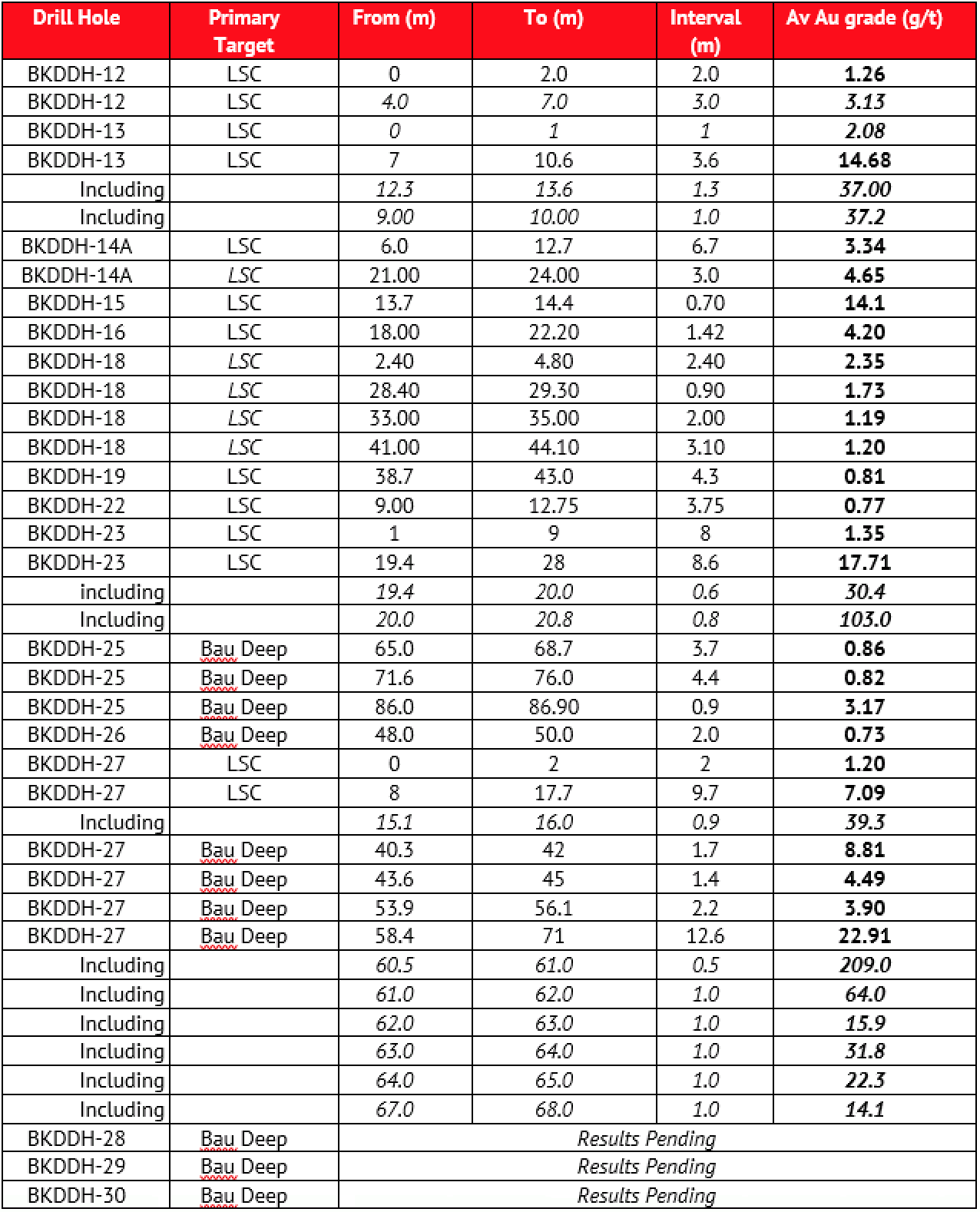

During the December Quarter gold assay results were received for BKDDH-12 to -27, inclusive, drilled during the initial Bekajang program up to August 2022 (Figure 4). As shown in Table 2, reproduced from the 22 November 2022 ASX Release, these included some exceptional intercepts.

Table 2 – Summary of significant intercepts from the initial BKDDH drilling program.

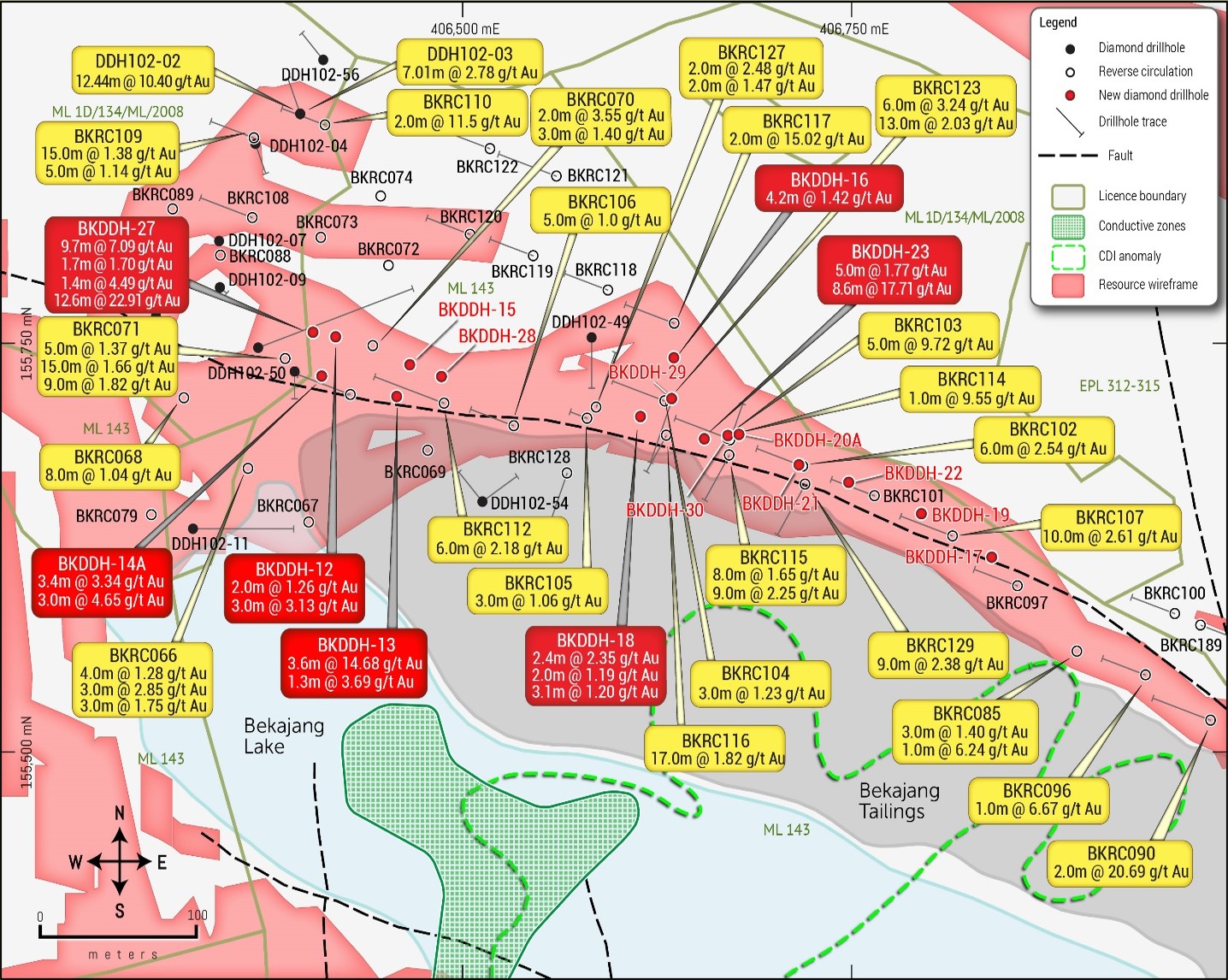

Highest gold grade intercepts were encountered along the northern flank of the historical Bekajang tailings dam where previous RC drilling (BKRC067 to 128) identified gold mineralisation near the top of the Bau Limestone and overlying units (predominantly Pedawan Formation shales and mudstones, but also clay dominated lithologies of unspecified age – “Z” lithologies – often intruded or replaced by dacite dykes.

Referred to as the “Limestone-Shale Contact (“LSC”) Target” typically, in this area, it occurs within 5m-30m of the surface and consequently most historical RC drilling terminated at depths of 50m or less. A summary of significant intercepts, summarised in Figure 4, illustrate LSC mineralisation ranges in thickness from 2m (BKDH109) to 29m (BKRC071) with reported gold grades ranging between 2.0 g/t and 5.0 g/t, although locally anomalously higher gold grades had been encountered – such as 12.4m @ 10.4 g/t in DDH102-02 (which includes a silicified interval of 1m @ 132 g/t).

Figure 4: Significant drillhole intercepts and Resource wireframe (in puce) located along the northern flank of the Bekajang tailings dam. Based on geophysical DIGHEM data, the footprint of an interpreted underlying intrusive is shown in green.

Figure 4: Significant drillhole intercepts and Resource wireframe (in puce) located along the northern flank of the Bekajang tailings dam. Based on geophysical DIGHEM data, the footprint of an interpreted underlying intrusive is shown in green.

Historical assay data also revealed mineralisation along this trend to be characteristically polymetallic, with silver and base metal enrichment. For example, BKRC107 encountered 9m @ 60.0 g/t Ag from 9m depth, within an interval also containing 2.7% Zn and 3.1% Pb. This association of gold mineralisation with base and semi-precious metals at Bekajang is not observed at Jugan.

Besra’s 2022 Bekajang Program was the first comprehensive fully cored program along this trend. As outlined in the ASX Release dated 23 August 2022, visually the cores highlighted pervasive hydrothermal alternation, with a number of the later holes (BKDDH-23, -27, -28, -29 & -30) drilled to depths >100m in order to specifically assess deeper mineralisation potential.

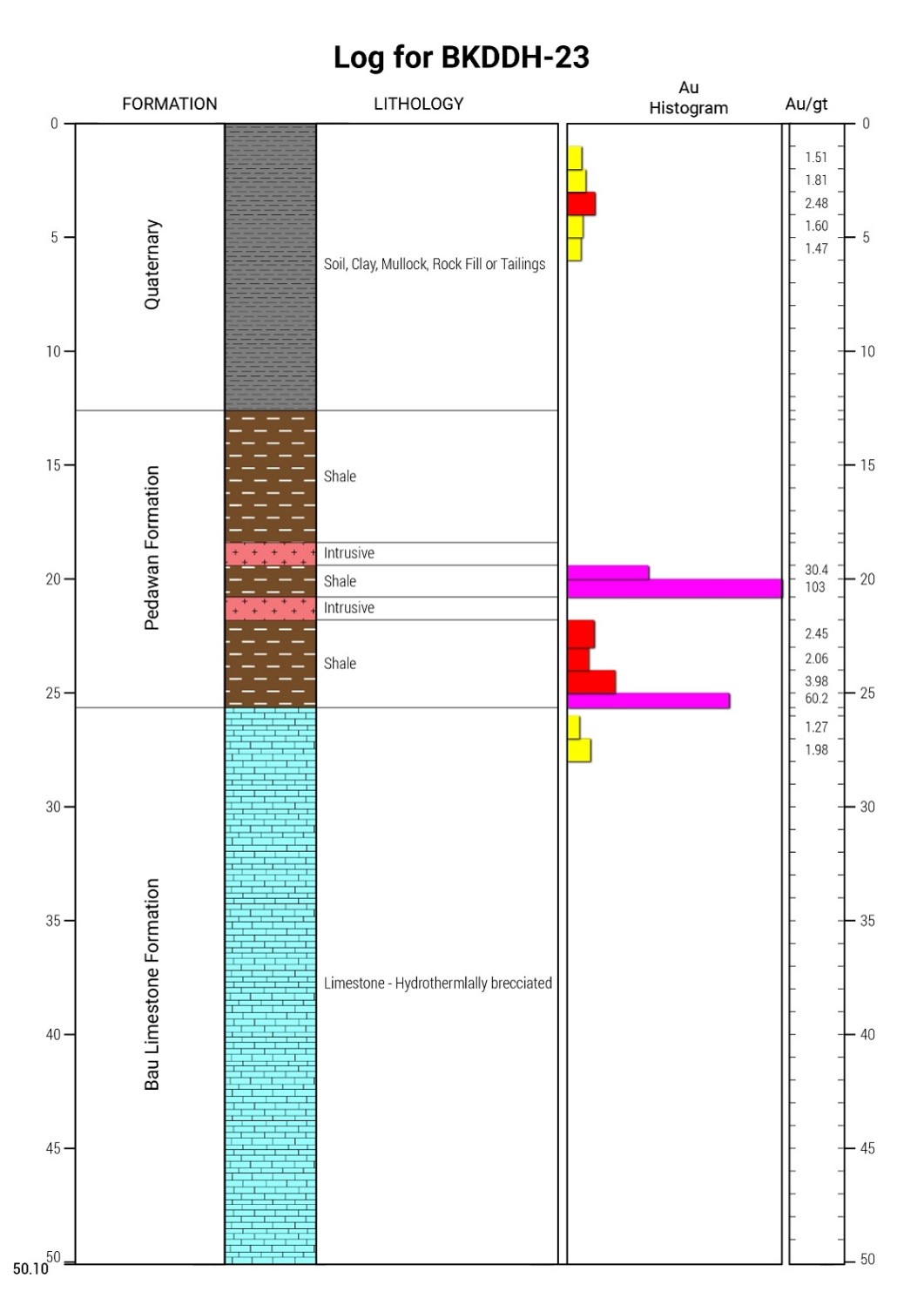

Figure 5: Summary of core lithology and gold assay results for BKDDH-23 showing exceptional gold tenor within the lower Pedawan formation at a depth of 18m-25m.

Figure 5: Summary of core lithology and gold assay results for BKDDH-23 showing exceptional gold tenor within the lower Pedawan formation at a depth of 18m-25m.

For some time it had been speculated that there may be a deeper structural component to the mineralisation given that the Resource wireframe, based on historical RC drilling, paralleled a surface mapped NNW-SSE trending fault (Figure 4).

Besra’s 2022 Bekajang Program confirmed mineralisation at the LSC target zone with significant intercepts noted in BKDDH-12, -13, -14A, -16, -18, -23, & -27.

Figure 5 shows the lithological log and correlated assay results for BKDDH-23. This typifies the extent of mineralisation at the LSC level, although in this drill hole exceptional bonanza grades were intercepted.

BKHHD-23 intercepted 8m @ 17.1 g/t, including a bonanza grade intercept of 103 g/t Au within the interval 20.0 to 20.8 m. As shown on Figure 5 the bulk of this high-grade mineralisation lies within a shallow (18m – 21m) shaley unit of the Pedawan Formation, which is bound by two thin intrusives.

Deeper Bau Limestone Mineralisation Potential

BKDDH-27 to -30, were drilled to depths of approximately 100m to evaluate the extent of hydrothermal alteration beyond the typical target depths of LSC RC drilling.

Of the assay results received during the December 2022 Quarter, BKDDH-27confirmed the presence of exceptional gold mineralisation some 40m below, and distinct from, the overlying LSC (Figure 6). Comprising a total interval of 15m this deeper mineralised zone included:

- 2m @ 8.81 g/t Au from 40m to 42m;

- 13m @ 22.91 g/t Au from 58m to 71m including –

-

- 0.5m @ 209 g/t Au from 60.5m to 61.0m,

- 1.0m @ 64.0 g/t Au from 61.0m to 62.0m,

- 1.0m @31.8 g/t Au from 63.0m to 64.0m, &

- 1.0m @22.3 g/t Au from 64.0m to 65.0m.

The highest gold grades, including an interval with a peak of 209 g/t, are associated with silicified alteration of the host limestone involving vugs, brecciation and veining (Figure 7).

Reflecting these exceptional grades was the occurrence of visible gold which is highly unusual along the Bau Gold Field corridor given that the mineralisation style is predominately Carlin-like, and intimately associated with either pyrite or arsenopyrite.

The grades over the interval 58.4m – 71.0m within BKDDH-27 includes some of the highest documented since modern exploration commenced within the Bau Gold Field corridor.

Karst Related Mineralisation

Although visual inspection of the recovered core from BKDDH-24, -25 & -26, drilled in the southwestern flank of the Bekajang tailings dam, showed weathered clay mineralisation extending down to depths of up to 80m, none of the assay results[5] indicated a gold tenor like that encountered in either the historical Tai Parit or BYG mine sites. Despite the presence of pervasive karstic and other alteration textures, as shown on Table 2, only minor gold mineralisation was identified at depth (BKDDH-25 3.7m @ 0.86 g/t, 4.4m @ 0.82 g/t, 0.9m @ 3.17g/t; BKDDH-26 2.0m @ 0.73 g/t).

Given their proximity to Tai Parit and BYG mines, this implies that the southwestern flank of the Bekajang tailings dam, was exposed to fluid flow and alteration histories sufficiently different from those operative and encompassing the nearby Tai Parit and BYG mines that produced their considerable mineral endowments.

Besra will undertake further analysis to understand the apparent controls of this partitioning and its implications for revising an exploration strategy to identify Tai Parit and BYG analogues within the Bekajang Prospect precinct.

Figure 6: Summary of core lithology and gold assay results for BKDDH-27 showing exceptional high, including bonanza grade, gold tenor within two distinct habitats, at the LSC and deeper within the Bau Limestone.

Figure 7: Portion of BKDDH-27 core, between 60.0m-63.7m, illustrating intense alteration in a zone hosting bonanza gold grade: 0.5m @ 209 g/t between 60.5m – 61.0m; 1m @ 64 g/t between 61.0 – 62.0 m; 1m @ 15.9 g/t between 62.0m – 63.0m & 1m @ 31.8 g/t between 63.0m – 64.0m.

Figure 7: Portion of BKDDH-27 core, between 60.0m-63.7m, illustrating intense alteration in a zone hosting bonanza gold grade: 0.5m @ 209 g/t between 60.5m – 61.0m; 1m @ 64 g/t between 61.0 – 62.0 m; 1m @ 15.9 g/t between 62.0m – 63.0m & 1m @ 31.8 g/t between 63.0m – 64.0m.

Jugan Project

The Jugan Project is located approximately 6km NE of Bau township (Figure 2). Contained within the Pedawan Formation, the mineralisation is shallowest across a local topographic high – Jugan Hill.

Previous drilling has formed the basis of the current JORC Resource at Jugan which comprises:

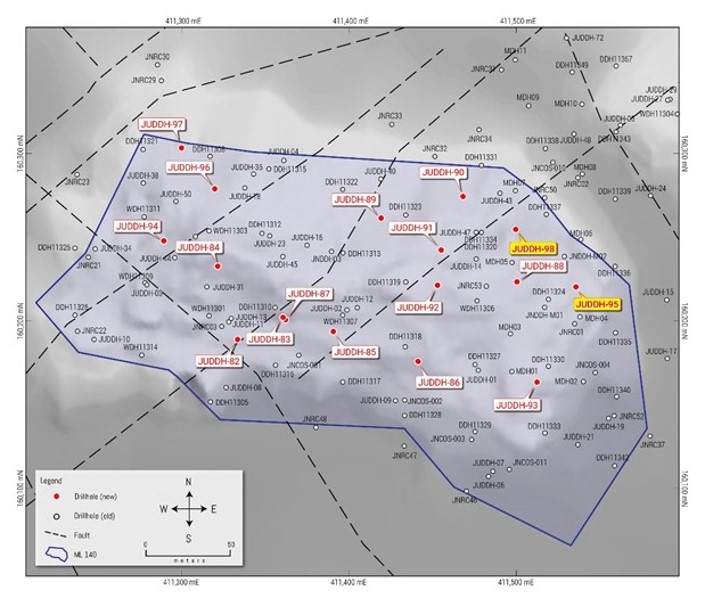

Figure 8: Showing the location of the 2021-2022 Jugan diamond drilling program, highlighting the locations of drill holes JUDDH-95 &-98 in the east of the prospect.

Figure 8: Showing the location of the 2021-2022 Jugan diamond drilling program, highlighting the locations of drill holes JUDDH-95 &-98 in the east of the prospect.

Previous drilling also revealed the bulk of mineralisation to be bound between two thrust faults; the hanging and footwall thrusts, vertically separated by between 40m – 100m. To the northeast of the prospect this thrust-bound sheet rolls over to form a steeply plunging limb, its contained mineralisation remaining open at depth, beyond the current limit of drilling intersecting these thrusts- circa 300m, sub-surface.

Assaying

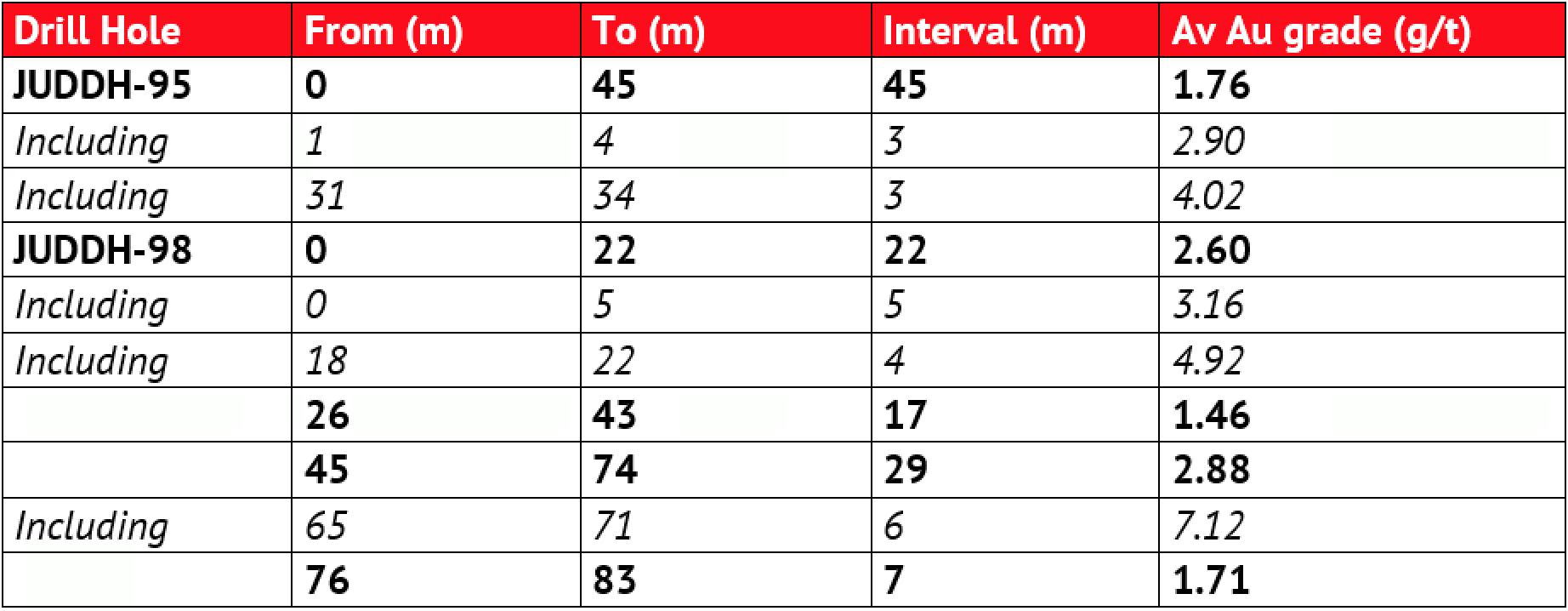

Gold mineralisation intercepts for JUDDH-95 & -98 previously released to the ASX on 21 October 2022, are illustrated in Figures 2 to 4 and summarised below as Table 3. These intercepts are estimated based on 0.5 g/t Au cut-off and 1m, or less, of internal dilution.

Table 3 – JUDDH-95 & -98 significant gold intercepts (true thickness).

Table 3 – JUDDH-95 & -98 significant gold intercepts (true thickness).

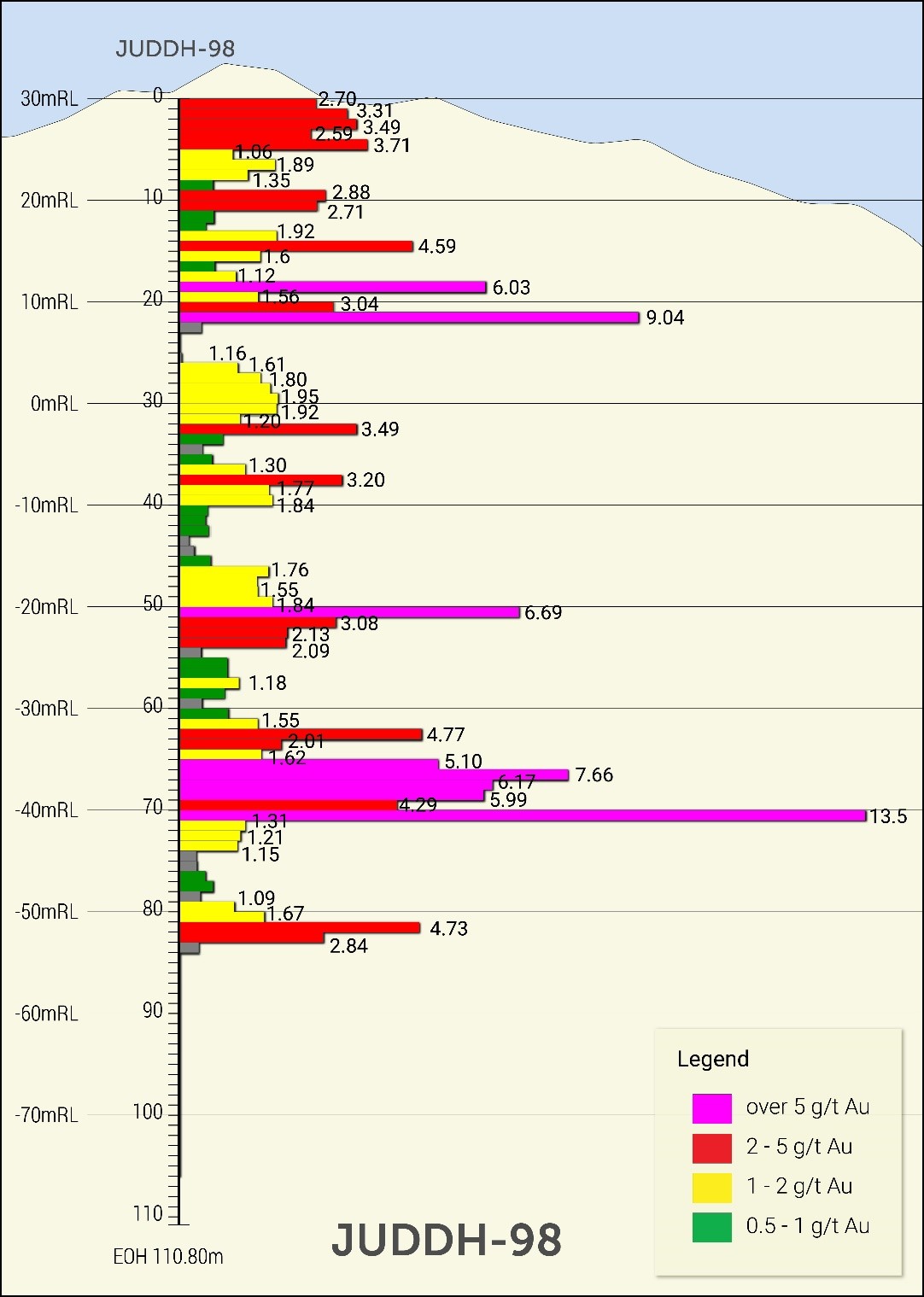

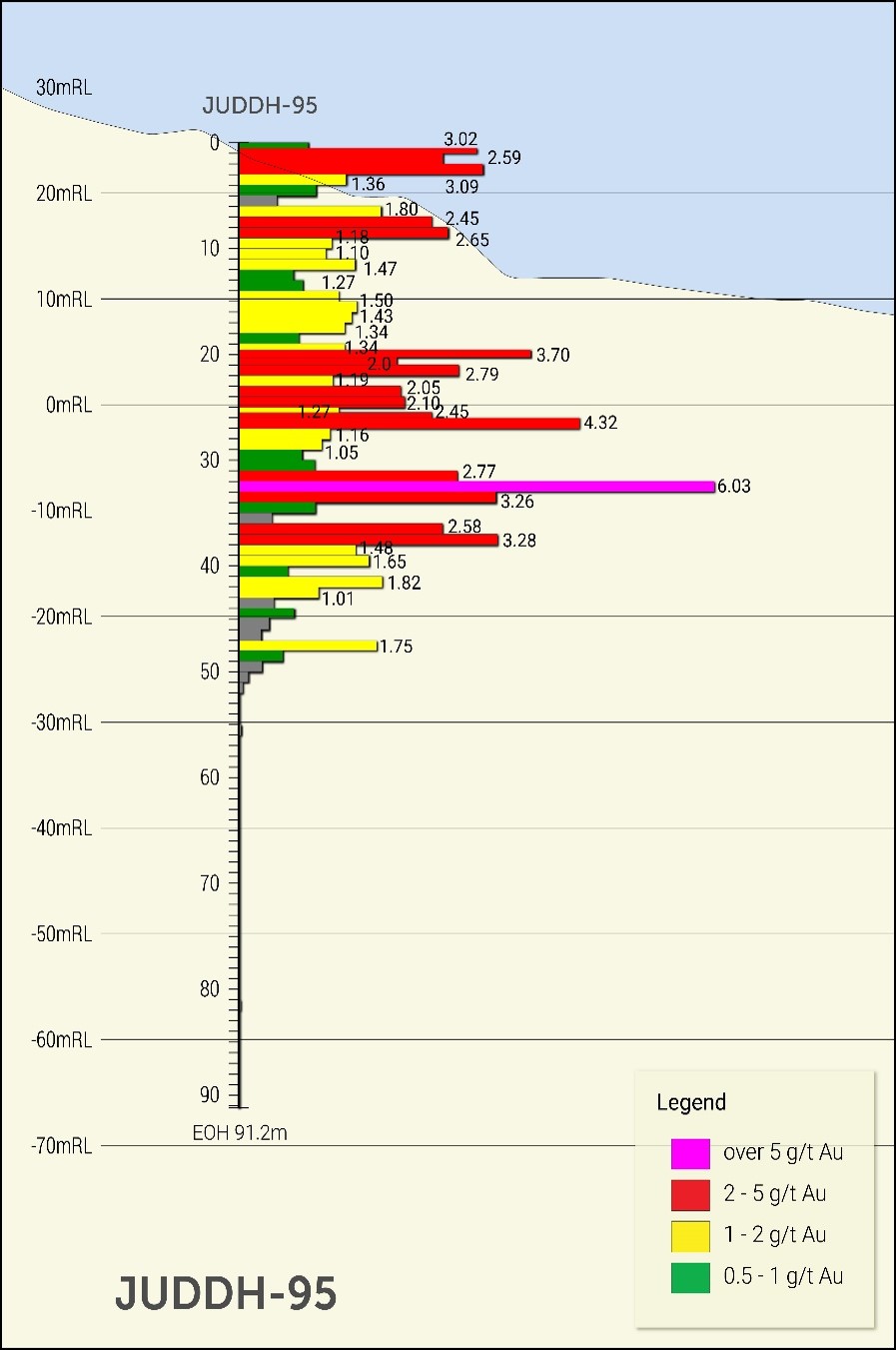

JUDDH-95 & -98 provided additional subsurface control near the crest of Jugan’s main body of mineralisation’s steeply NE plunging limb, nearly 200m from outcrop. Both holes intercepted superior grades of mineralisation over thick intervals from the surface (Figures 9 & 10). JUDDH-98 confirmed the lateral extension to Jugan’s main body of mineralisation, as previously determined in this area by intercepts in historical holes JNDDH-M02 and MDH05, together with its thickening – mineralisation being intercepted virtually continuously some 70m vertically from the surface at an average gold grade of approximately 1.8 g/t (Figure 9). Of note, at depth in this region, is the interception by several holes of higher gold grade intervals, exceeding 4 g/t. In JUDDH-98 this coincides with an interval of 10m thickness with an average grade of 4.26g/t Au, including 6m @ 7.12 g/t Au, between 65m & 71m. This particular interval can be correlated with similar higher-grade intervals intercepted in MDH-08 and DDH-1337.

Core from this higher-grade interval in JUDDH-98 displays strong carbonate and dickite veining, arsenopyrite and pyrite veining of 5-10%, vein selvedges, stockworks, as well disseminated fine sulphides in bands and breccias of up to 3-5%.

Figure 9: JUDDH-98, showing intercepted mineralisation grades based on nominal, true, 1m sample widths. JUDDH-98 intercepted significant intervals of higher-than-average historical global grades (1.5-1.6 g/t Au) including a maximum of 13.5 g/t Au.

Figure 9: JUDDH-98, showing intercepted mineralisation grades based on nominal, true, 1m sample widths. JUDDH-98 intercepted significant intervals of higher-than-average historical global grades (1.5-1.6 g/t Au) including a maximum of 13.5 g/t Au.

Figure 10: JUDDH-95, showing intercepted mineralisation grades based on nominal, true, 1m sample widths. Virtually continuous mineralisation extends from the surface down to 45m near the interpreted footwall thrust, including an interval with a maximum grade of 6.03 g/t Au.

Figure 10: JUDDH-95, showing intercepted mineralisation grades based on nominal, true, 1m sample widths. Virtually continuous mineralisation extends from the surface down to 45m near the interpreted footwall thrust, including an interval with a maximum grade of 6.03 g/t Au.

Flotation Scoping Study

Flotation test work of bulk samples of Jugan mineralisation continued to be undertaken by ZJH Minerals Company Ltd of Zingzen China during the December 2022 Quarter. Initial plans for design of the test-plant are currently being reviewed and finalisation, together with a procurement schedule, is due during the March 2023 Quarter.

Jugan Environmental Impact Assessment

During the December 2022 Quarter, Chemsain Konsultant Sdn Bhd completed community and other stakeholder dialogue meetings prior to finalising the EIA Report. This was submitted to the Natural Resources and Environment Board (“NREB”) Sarawak for its consideration. At the same time an Application for Early Commencement Works (“ECW”) was lodged in order to undertake drilling activities prior to a determination of the EIA. This ECW was approved, by the NREB, on 21 December 2022.

Corporate

On 31 December 2022, the Company held cash reserves of $3.082m and no debt, which showed the impact of the $1m private placement in October and funds $3.007 received from the underwriter of the Entitlement Offer (see below).

At balance date a further $1.956m was held on trust by the Company’s share registry Computershare Investor Services P/L pursuant to the Entitlement Offer.

As at 3 January 2023, with the terms of the Entitlement Offer being satisfied, the funds held on trust were released to the Company, increasing the Company’s cash reserves to $5.038m.

On 3 October 2022 the Company disclosed to the market its 2022 Corporate Governance Statement pursuant to ASX Listing Rule 4.10.3.

On 10 October 2022 Besra announced the signing of a Subscription Agreement with Quantum Metal Recovery Inc (“Quantum”), a substantial shareholder of the Company, for the issue of 11,111,111 new CDIs to raise A$1,000,000. The CDIs were issued pursuant to the Company’s existing capacity under ASX Listing Rule 7.1 at an issue price of A$0.09 per CDI and ranked equally with existing fully paid CDIs on issue. Proceeds are to be used to fund activities at the Bau Gold Project and general working capital.

On 18 November 2022 the Company announced changes to the board with the resignations of Messrs Mark Eaton and Robert Dunne.

On 18 November 2022 the Company submitted a substantial shareholder notice disclosing that Quantum, having acquired the shares through the Placement and an Off-Market Transfer, had increased its CDI holdings from 9.72% to 18.51%.

On 25 November 2022 the Company announced a 1 for 3 Non-Renounceable Entitlement Offer of CDIs at $0.05 per CDI to raise approximately A$5.1m (before costs) (“Entitlement Offer”). The Entitlement Offer was fully underwritten by Quantum. Proceeds from the Entitlement Offer will be applied to:

• Jugan Resource Review & Feasibility Studies;

• Jugan Test Processing Plant;

• Resource Exploration & Drilling;

• In-Country administration and overheads; and

• General working capital and administration.

On 25 November 2022 the Company disclosed to the ASX that it was in advanced discussions with its substantial shareholder, Quantum, pursuant to which it is proposed that it will provide up to US$300 million in financial support, commencing as soon as CY2023, by way of a gold offtake purchase facility.

The proposed facility, if implemented, would enable Besra to advance exploration and development planning, and to expedite production at the Bau Gold Project in Sarawak, Malaysia. It is currently proposed that stream deliveries would be based on gold production from Bau, with Besra to receive 90% of the spot gold price for each ounce delivered subject to a monthly cap. While no agreement has yet been reached, any agreement would be subject to Besra Board, shareholder and regulatory approval including compliance with ASX listing rules.

On 6 December 2022 the Company disclosed and despatched the Entitlement Offer Booklet to Eligible Security Holders.

On 13 December 2022 the Company announced a change to the Board with the resignation of Mr Andrew Worland.

On 15 December 2022 the Company held its Annual General Meeting. Resolution 1 was withdrawn prior to the commencement of the Meeting (concerning the re-election of Mr Andrew Worland) but the remaining five (5) resolutions were passed by way of a poll. Details of each resolution, proxy votes and votes cast on the poll were disclosed to the market in accordance with ASX Listing Rule 3.13.2.

On 29 December 2022 the Company disclosed a variation in the Underwriting Agreement and completion of the Entitlement Offer with amendments for the date of receipt of funds for the underwritten Shortfall CDIs being extended until 5:00pm (AWST) on Friday, 30 December 2022 and the issue and allotment date for the New CDIs extended to Tuesday, 3 January 2023.

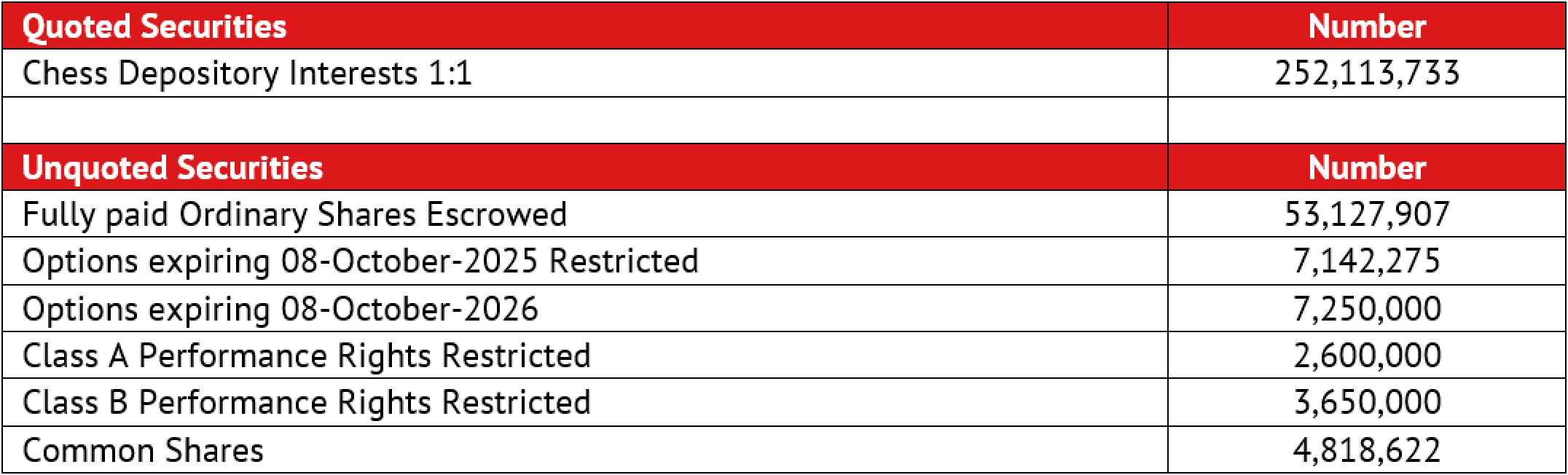

Securities on issue at 31 December 2022 were:

Subsequent Events

On 3 January 2023 the Company sought application for the quotation of 101,748,155 CDIs at a price of $0.05 each after the successful completion of the Entitlement Offer. This resulted in an increase of the Quoted CDIs to 353,861,888.

On 20 January 2023 the Company provided an Investor Update which included, inter alia, that the Joint Venture had decided to allow ML 1D/136/ML/2008 to lapse at the conclusion of its 20 year term, given that it was extensively impacted by the subsequent gazettal of the Dered Krian National Park and did no form part of the Joint Venture’s core activities. Its expiry resulted in an impairment to the total Resources Inventory with the total Resources now comprising Measured 3.4 Mt @ 1.5g/t Au for 166.9koz, Indicated 16.4 Mt @ 1.57g/t Au for 824.8 koz and Inferred 47.9 Mt @ 1.29 g/t Au for 1,989 koz as shown on Table 1.

Additional ASX Listing Rule Disclosures

ASX Listing Rule 5.3.1 – Payments for direct exploration expenditure during the quarter totalled $0.685m Details of the exploration activities undertaken during the December 2022 quarter are as noted in this Activities Report.

ASX Listing Rule 5.3.2 – The Company confirms there were no mining production and development activities undertaken during the December 2022 Quarter.

ASX Listing Rule 5.3.3 – There were no changes to Besra’s interests in the Bau Gold Project at 30 June 2022.

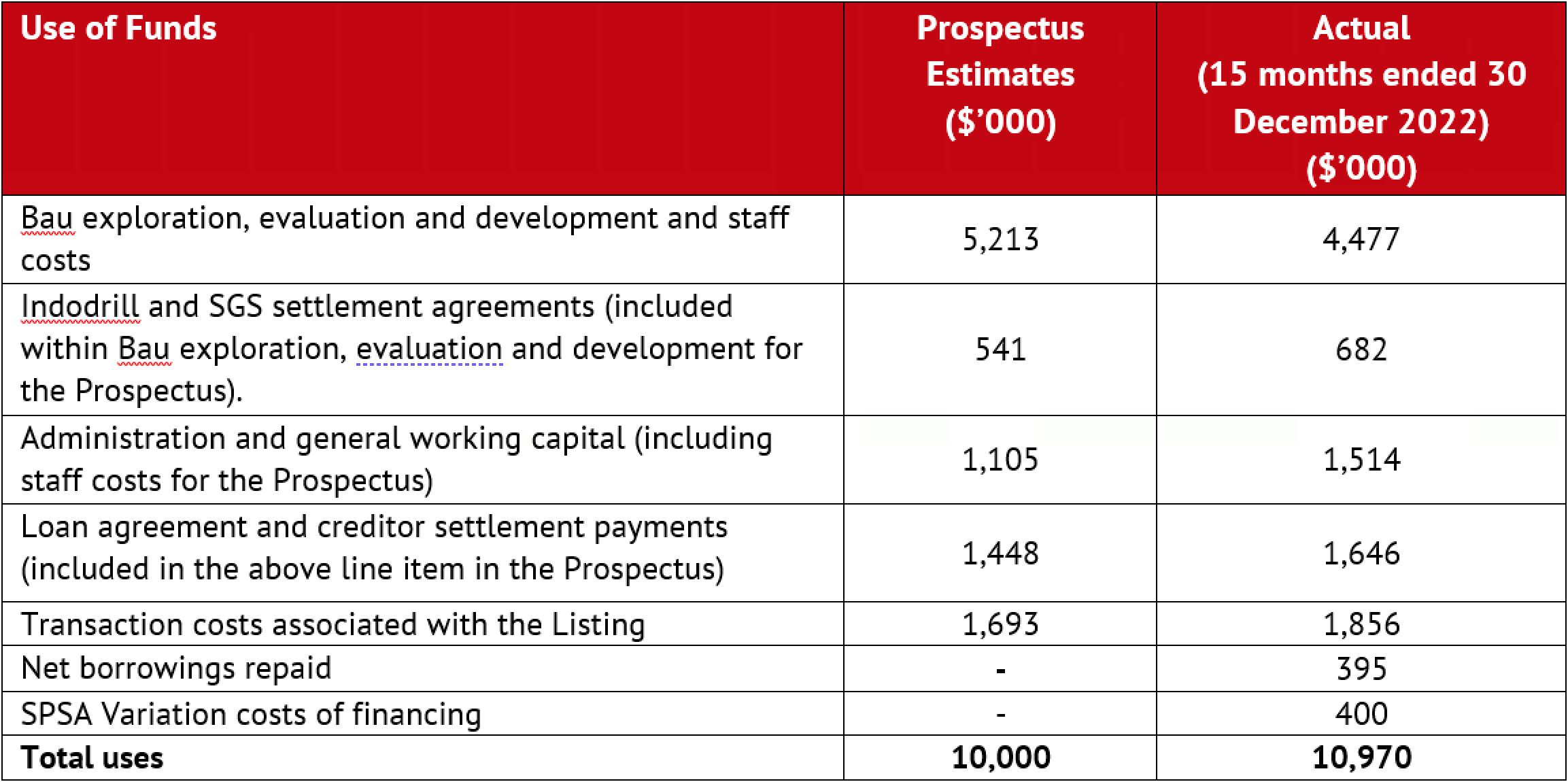

ASX Listing Rule 5.3.4 – Besra was admitted to the official list of the ASX on 8 October 2021 following completion of an IPO raising. The December 2022 quarter is included in a period covered by the use of funds statement in the IPO prospectus lodged with ASX under Listing Rule 1.1 condition 3.

A comparison of the Company’s actual admission to 31 December 2022 against the estimated expenditure in the use of funds statement is set out below as required by ASX Listing Rule 4.7C.2.[8]

The Company notes:

- New capital was received within the first year since admission to expedite the Bau Gold Project, following the positive results from the planned 2022 drilling programs. In October 2022, $1,000,000 was raised from a Placement with the Company’s Substantial Shareholder, Quantum Metals Recovery Inc.

- Following the receipt of the Placement funds, together with the announcement of the Entitlement Offer on 25 November 2022, Besra’s operations accelerated, as reflected in the increased its cash reserves.

- Activities at the Bau Gold Project continued during the December 2022 Quarter focused on the Bekajang and Jugan Prospects. This included completion and lodgement with the relevant authorities of an EIA for the Jugan Prospect.

ASX Listing Rule 5.3.5 – payments to related parties during the Quarter as outlined in sections 6.1 and 6.2 of the Appendix 5B consisted of the following:

- Non-executive director fees included in staff costs for services provided during the quarter totalled $80k are included in 1(d) of Appendix 5B.

- Executive director fees for services provided during the quarter and capitalised to exploration and evaluation costs totalled $64k are included in 2.1(d) of Appendix 5B.

This ASX release was authorised by the Audit Committee of Besra Gold.

For further information:

| Australiasia | North America |

| Ray Shaw Chief Executive Officer Email: ray.shaw@besra.com |

James Hamilton Investor Relations Services Mobile: +1 416 471 4494 Email: jim@besra.com |

Competent Person’s Statement

The information in this Announcement that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr. Kevin J. Wright, a Competent Person who is a Fellow of the Institute of Materials, Minerals and Mining (FIMMM), a Chartered Engineer (C.Eng), and a Chartered Environmentalist (C.Env). Mr. Wright is a consultant to Besra. Mr. Wright has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code (2012 Edition) of the Australasian Code for Reporting of Exploration Results, and a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

Kevin J. Wright consents to the inclusion in this Announcement of the matters based on his information in the form and context that it appears.

Disclaimer

This Announcement contains certain forward-looking statements and forecasts concerning future activities, including potential delineation of resources. Such statements are not a guarantee of future performance and involve unknown risks and uncertainties, as well as other factors which are beyond the control of Besra Gold Inc. Actual results and developments may differ materially from those expressed or implied by these forward-looking statements depending upon a variety of factors. Nothing in this Announcement should be construed as either an offer to sell or a solicitation of an offer to buy or sell securities.

This Announcement has been prepared in accordance with the requirements of Australian securities laws and the requirements of the Australian Securities Exchange (ASX) and may not be released to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933 and may not be offered or sold in the United States except in transactions exempt from, or not subject to, registration under the US Securities Act and applicable US state securities laws.

Unless otherwise indicated, all mineral resource estimates and Exploration Targets included or incorporated by reference in this Announcement have been, and will be, prepared in accordance with the JORC classification system of the Australasian Institute of Mining and Metallurgy and Australian Institute of Geoscientists.

Disclosure

The Pejiru Sector lies within MC/KD/01/1994 which has been pending renewal for a number of years. As outlined in the Malaysian Solicitor’s Report on Title (Attachment G) of the Replacement Prospectus of Besra dated 8 July 2021, until a decision is made, the intention of section 48(9) of the Minerals Ordinance is to enable mining activities to continue on a pre-existing licence, in those prior lands of MC/KD/01/1994, until a determination of the renewal is made.

The information in this announcement is based on the following publicly available announcements previously lodged on the SEDAR platform which are available on https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00001815. or on Besra’s website.

1 Besra Gold Inc Bau Gold Project Sarawak Malaysia Exploration Target Inventory. Lodged SEDAR Platform Feb 26, 2021.

2 Besra Bau Project – Mineral Resource and Ore Reserve Updated to JORC 2012 Compliance. Lodged SEDAR Platform Nov 22, 2018.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

[1] Refer Prospectus dated 8 July 2021, Section 3.11 and Attachment G.

[2] Jugan Exploration Target ranges between 2.0 – 3.2 Mil Oz Au based on a range of grades of 1.82 – 2.50 g/t Au.. The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

[3] Updated to include an impairment following the expiry of Ex-ML 136, as announced to the ASX on 20 January 2023.

[4] Refer ASX release dated 22 November, 2022 “Exceptional High and Bonanza Grade Gold Intercepts Bekajang.”

[5] Refer ASX Release dated 22 November 2022.

[6] Jugan Exploration Target ranges between 4.9 Moz – 9.3 Moz based on a range of grades of 1.82 – 2.50 Au g/t.

[7] The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

[8] Forecast expenditure classifications used in the Prospectus may differ from the classifications used in the Appendix 5B.