1 August 2022

ASX: BEZ

HIGHLIGHTS

- Jugan drilling phase, comprising 17 fully cored diamond drill holes totalling 2022m, successfully completed.

- Drilling results have surpassed historical drilling and confirmed that Jugan represents a stand-alone development opportunity, indicating:

- Higher grades than historical global averages;

- Lateral (dip) continuity of the main mineralised body; and

- Larger surface outcrop footprint of mineralisation.

- Revision of Resource modelling will be undertaken following receipt of all assay results, Jugan currently hosting:

- Environmental Impact Assessment covering Jugan Project and further flotation studies of Jugan bulk samples currently in progress.

- Besra completed 15 fully cored diamond drill holes, totalling 1047m, at its Bekajang Project.

- Multi-target drilling program at Bekajang already identified two new deeper, potential higher grade, targets:

- Deeply weathered karstic profiles; and

- Higher grade gold endowment associated with predicted sub-vertical hydrothermal conduit.

Besra’s CEO, Dr Ray Shaw commented:

“Drilling results have elevated Jugan as having stand-alone development potential, and various activities are underway to address critical path issues to development. At the same time, visual inspection of deeper Bekajang core has been very encouraging, raising the possibilities of new resource opportunities, including penetrated lithologies in two areas reminiscent of the nearby highly productive former Tai Parit and BGY mines.

The Board of Besra Gold Inc (ASX: BEZ) (“Besra” or “Company”) is pleased to provide this Activities Report for the quarter ending 30 June 2022.

BACKGROUND

Overview of Bau Gold Project

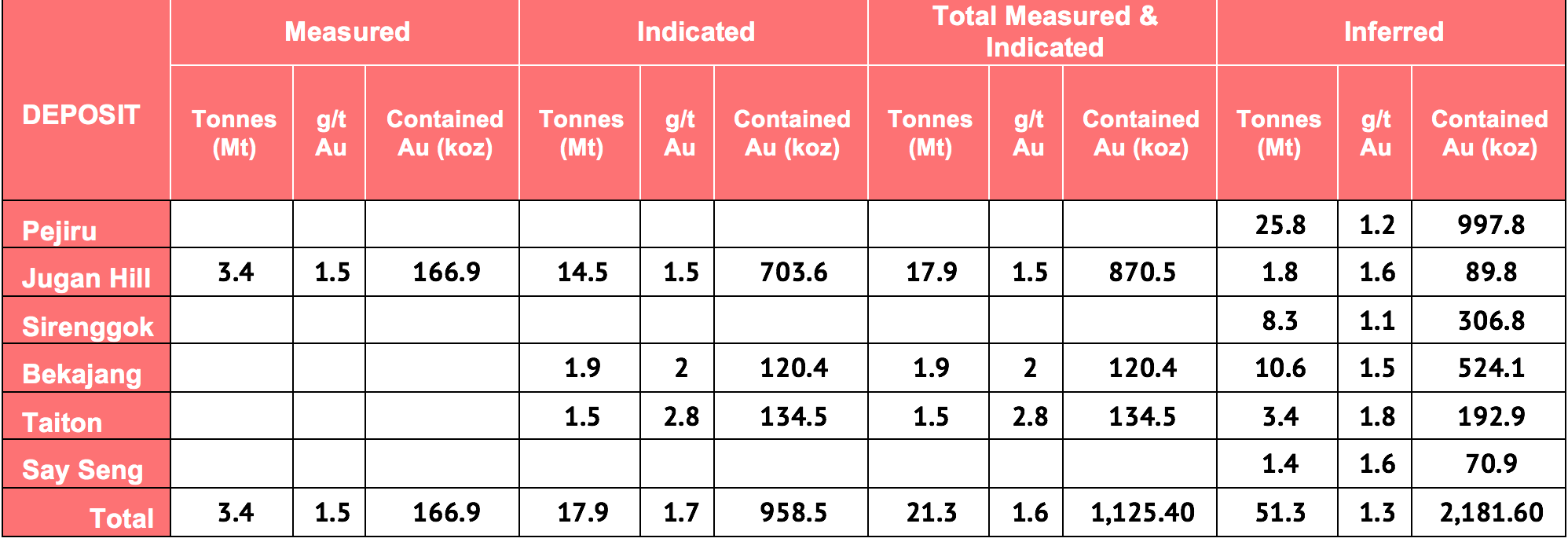

The Bau Gold Project is located 30km – 40km from Kuching, the capital city of the State of Sarawak, Malaysia, on the island of Borneo (Figure 1). Bau township is located approximately 6km to the SW of Jugan (Figure 2).

Besra controls, directly and indirectly, a 97.8% interest (92.8% on an equity adjusted basis) of the Bau Gold Project. This project lies at the western end of an arcuate metalliferous belt extending through the island of Borneo. In Kalimantan, the Indonesian jurisdiction portion of Borneo Island, this belt is associated with significant gold mining areas including Kelian (7 Moz) and Mt Muro (3 Moz).

The Bau Gold Project is defined by a gold bearing mineralisation system covering approximately an 8 km x 15 km corridor, centred on the township of Bau. Within this corridor the Company has identified total Resources of 72.6Mt @ 1.4 g/t for 3.3Moz of gold, involving a number of discrete deposits (Table 1) together with an Exploration Target ranging between 4.9 Moz and 9.3 Moz [4], [5] (on a 100% basis). The Bau Gold Project is well serviced by first class infrastructure including ready access to deep water ports, international airport, grid power, communications, and a multitude of service providers.

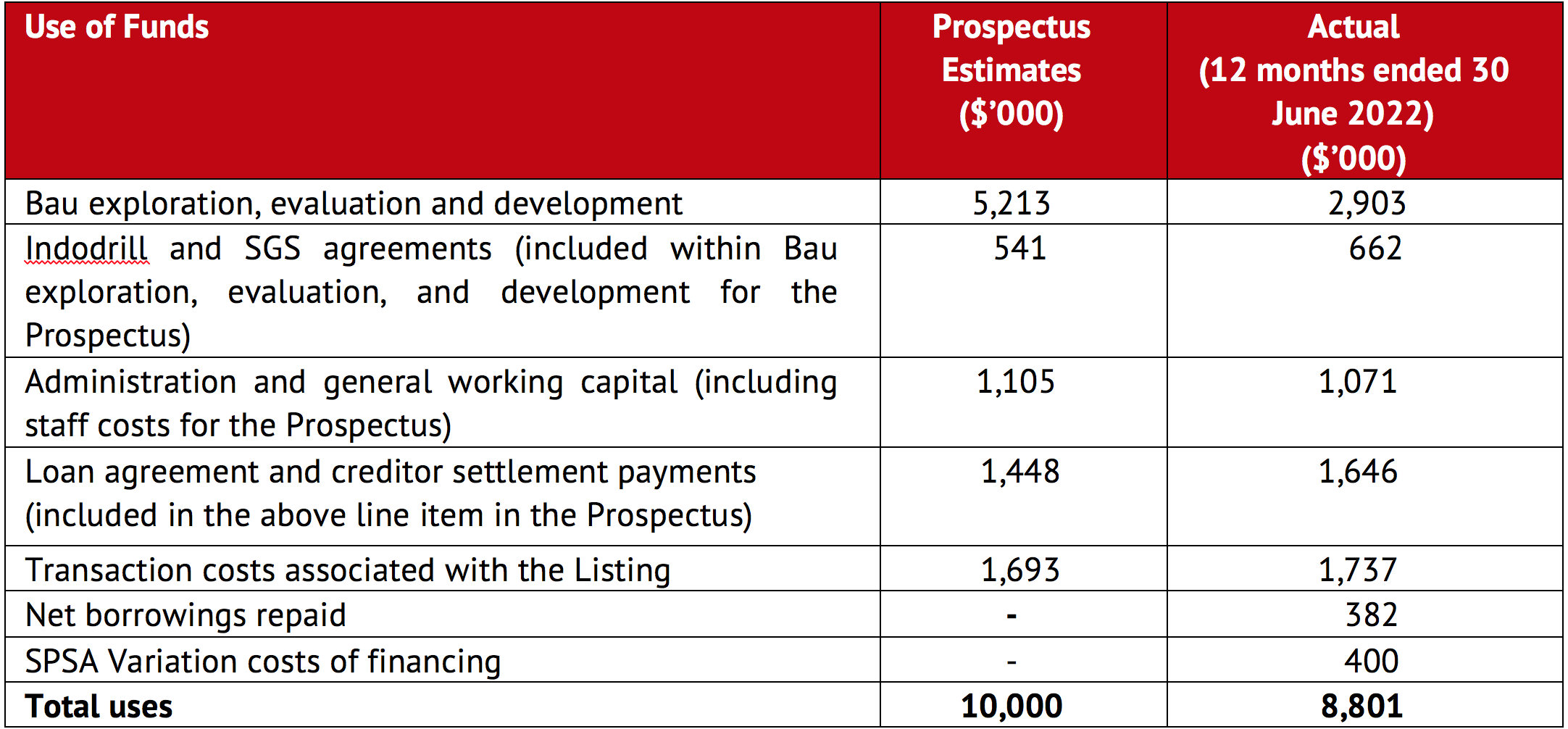

Table 1: JORC 2012 Compliant Resources for the Bau Gold Field Project.

Table 1: JORC 2012 Compliant Resources for the Bau Gold Field Project.

Figure 1: Location of Bau Gold Project. Inset shows tenement interests within Sarawak.

Figure 1: Location of Bau Gold Project. Inset shows tenement interests within Sarawak.

Jugan Project

The Jugan Project is located approximately 6 km NE of Bau township (Figure 2). Contained within the Pedawan Formation, the mineralisation is shallowest across a local topographic high – Jugan Hill.

Previous drilling has formed the basis of the current JORC Resource at Jugan which comprises:

- Measured + Indicated Resource of 870,000 Oz1 at 1.5 g/t Au;

- Inferred Resource of 90,000 Oz1 at 1.6 g/t Au; and

- Additional Exploration Target[6], [7] of 2.0 – 3.2 Moz at 1.8 – 2.5 g/t Au.

Previous drilling also revealed the bulk of mineralisation to be bound between two thrust faults; the hanging and footwall thrusts, vertically separated by between 40m – 100m. To the northeast this thrust-bound sheet rolls over to form a steeply plunging limb, its contained mineralisation remaining open at depth, beyond the current limit of drilling – circa 300m, sub-surface.

Figure 2: Location of the Jugan & Bekajang drilling activities (highlighted within red boxes) on the Bau Gold Field corridor, approximately 30km from Sarawak’s capital, Kuching (refer inset).

2021-2022 Drilling Program – Jugan Project

The Jugan component of Besra’s 2021-2022 drilling program commenced in early November 2021. During the June Quarter, approximately 1,083m of fully cored drilling was undertaken to complete a total of 17 drill holes totalling 2,022m. Most drill holes were designed with dual objectives; provide additional infill drilling control at shallower depths and step-out or reconnaissance to provide additional geological control beyond the existing Resource envelope, at depth or along strike.

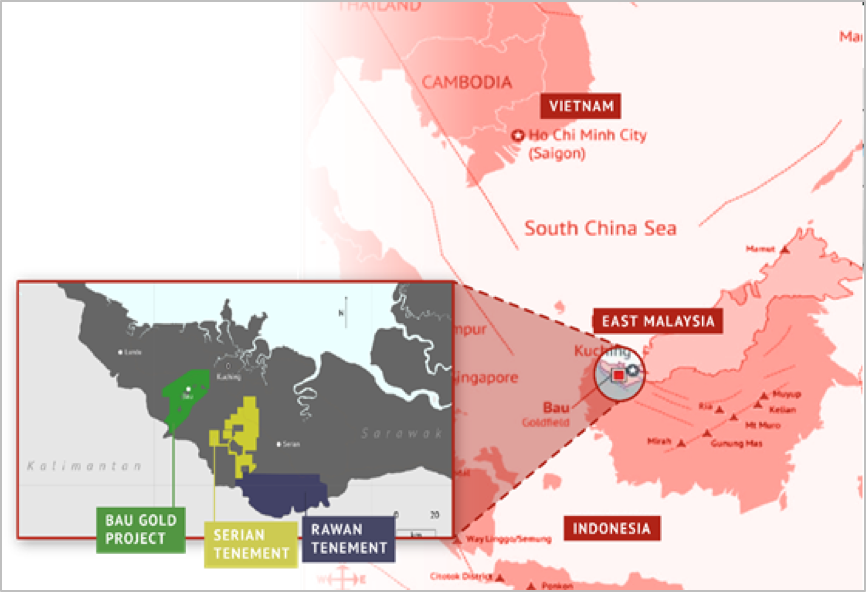

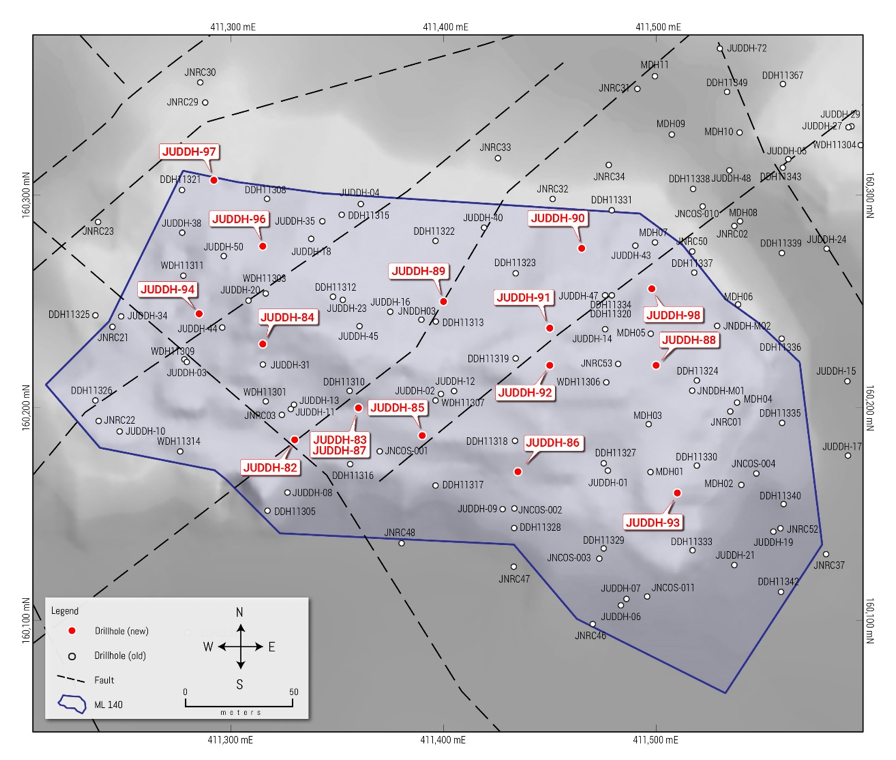

The total 17-hole program is shown in Figure 3 and drill hole details are tabulated in Table 2.

Table 2: Jugan Project diamond drill hole specifications

Table 2: Jugan Project diamond drill hole specifications

Assaying

During the June 2022 Quarter assay results were received from SGS for a further two batches of core samples (drill holes JUDDH-89 to 94, inclusive). These were released to the market on May 22, 2022 and June 23, 2022. Assay results for samples of the remaining drill holes (JUDDH-95, and 97, 98) shipped to SGS’s laboratories at Pt Klang during the Quarter are pending.

Figure 3: Locations of Jugan 2021-2022 drilling program, relative to historical drilling within the Jugan Prospect.

Figure 3: Locations of Jugan 2021-2022 drilling program, relative to historical drilling within the Jugan Prospect.

Significant intercepts disclosed to the market during the June Quarter are:

- JUDDH-89: 64m @ 1.90 g/t Au from 145m to 209m; and

19m @1.50 g/t Au from 72 to 91m;

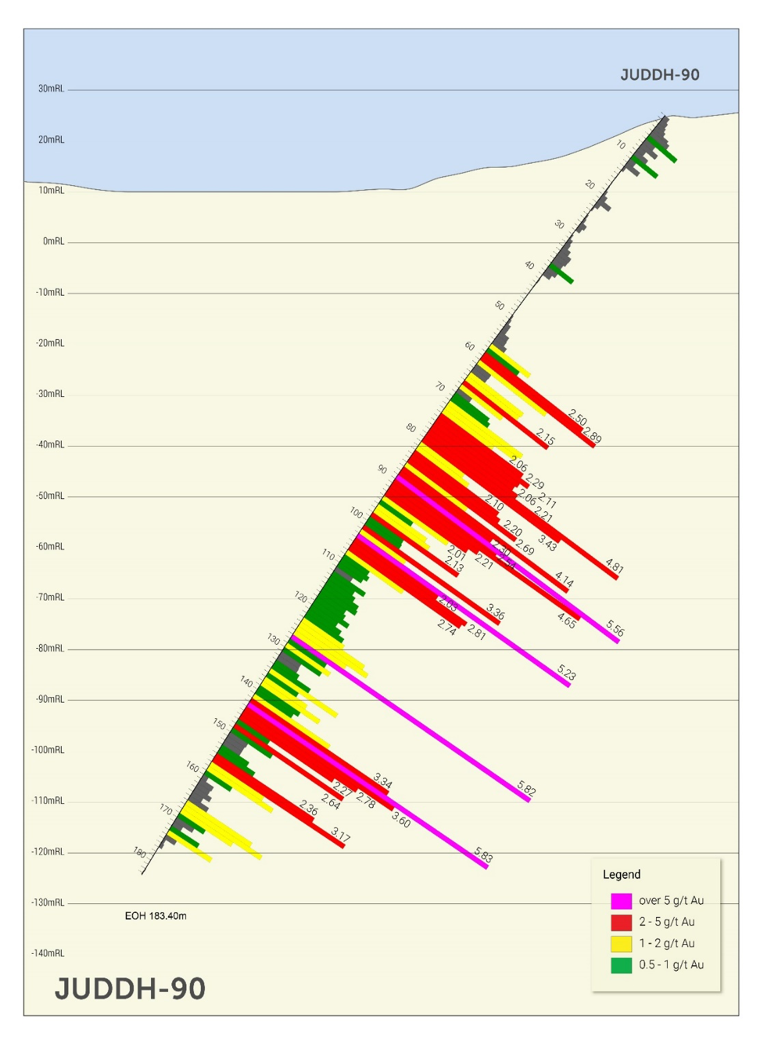

- JUDDH-90: 67m @ 1.76 g/t Au from 64m to 131m; and

17m @1.90 g/t Au from 133m to 150m.

- JUDDH-91: 63m @ 1.9 g/t Au from 19m to 82m;

including 11m @ 3.5 g/t from 41m to 52m.

- JUDDH-92: 36m @ 1.2 g/t Au from 33m to 69m; and

7m @1.2 g/t Au from 15m to 22m.

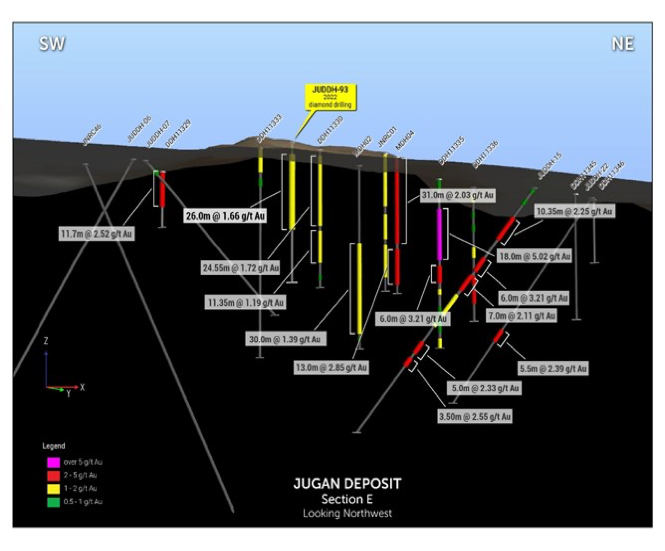

- JUDDH-93: 26m @ 1.7 g/t Au from 4m to 30m; and

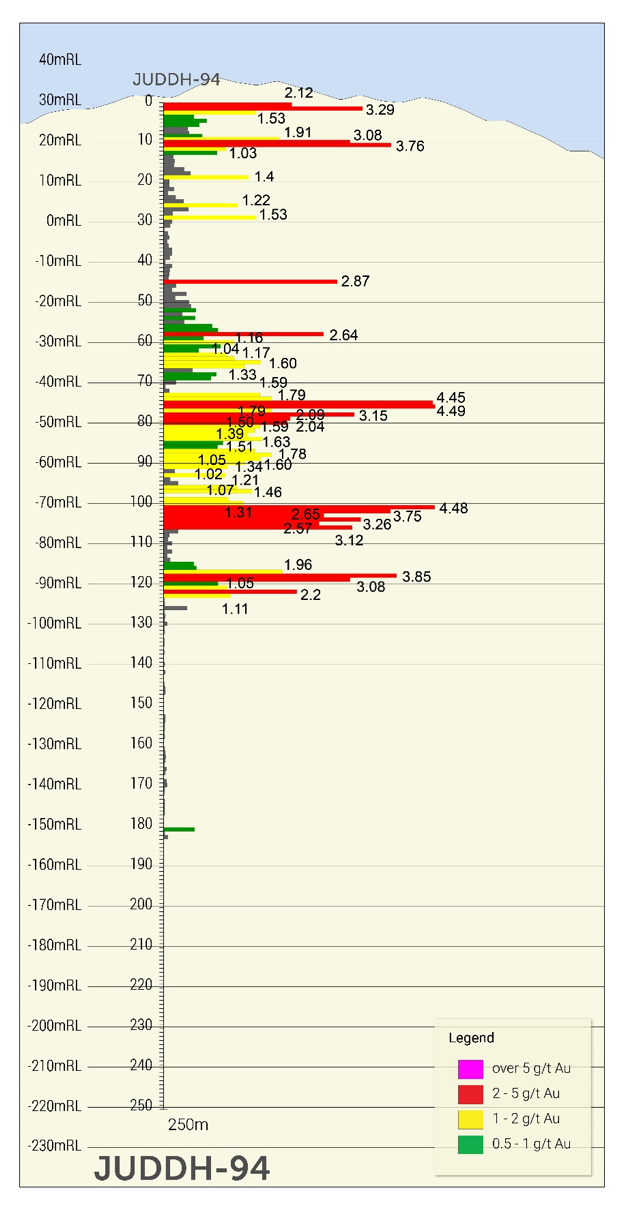

- JUDDH-94: more than 66m of mineralisation including

6m @ 1.5 g/t Au from 0m to 6m;

5m @ 1.9 g/t Au from 8m to 13 m;

14m @ 1.1 g/t Au from 55m to 69m;

21m @ 1.8 g/t Au from 72m to 93m;

11m @ 2.3 g/t Au from 95m to 106m; and

9m @ 1.7 g/t Au from 114 to 123m.

Overall, the drilling results have encountered substantially thicker and more consistent mineralisation than otherwise indicated by the historical drilling results. Mineralisation intercepts from the recent drilling also have higher gold grades compared to the historical average global grades at Jugan. The results for JUDDH-82, -83, -85, -86, -87 & -93 indicate a larger surface mineralisation footprint across Jugan Hill. In turn, this implies lower strip ratios in this vicinity than had been anticipated, making it more favourable to future potential open-pit mining.

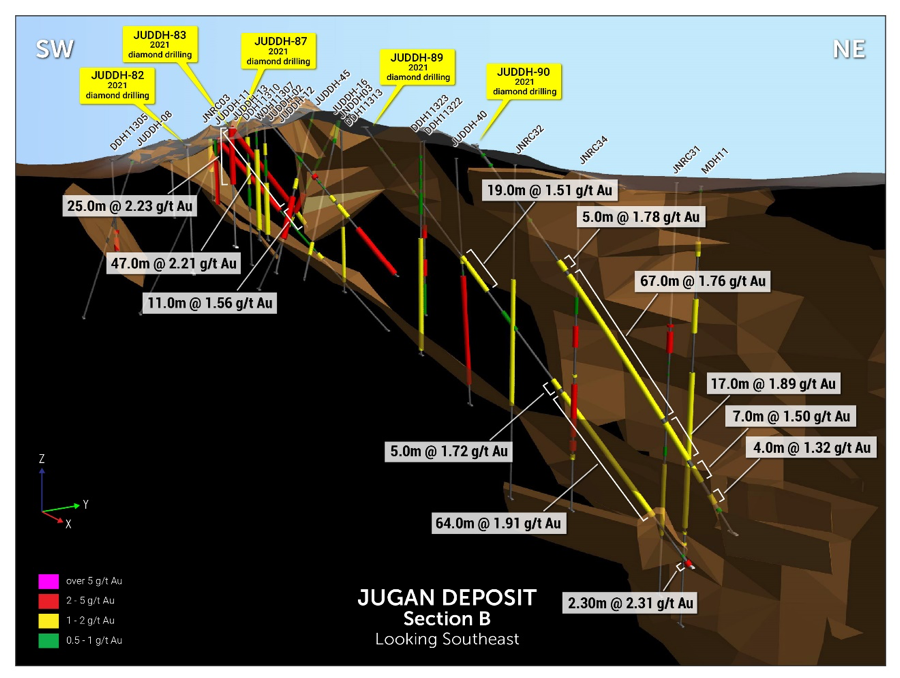

Figure 4: Perspective showing the inclined drill hole trajectories of JUDDH-89 & -90, allowing down-dip correlation between historical vertical drill holes, within the historical Resource wireframe envelope (brown colouration).

JUDDH-89 & -90 provided the first significant sub-surface control along the plunge of the main Jugan mineralisation (Figure 4). JUDDH-90 encountered a total of ~100m of virtually continuous mineralisation including several intervals where gold grades exceed 4.0 g/t (Figure 5). Historical drilling and Resource

Figure 5: JUDDH-90, showing intercepted mineralisation grade and thicknesses based on nominal 1m sample widths. Note that the intercepted thicknesses are not true thicknesses because of the inclined trajectory of the drill core.

Figure 5: JUDDH-90, showing intercepted mineralisation grade and thicknesses based on nominal 1m sample widths. Note that the intercepted thicknesses are not true thicknesses because of the inclined trajectory of the drill core.

estimations have been largely based on vertical holes the resultant oblique intercepts of dipping layers, making

it difficult to ascertain the lateral continuity of mineralisation, particularly in the northeast direction where the main body of mineralisation rapidly plunges.

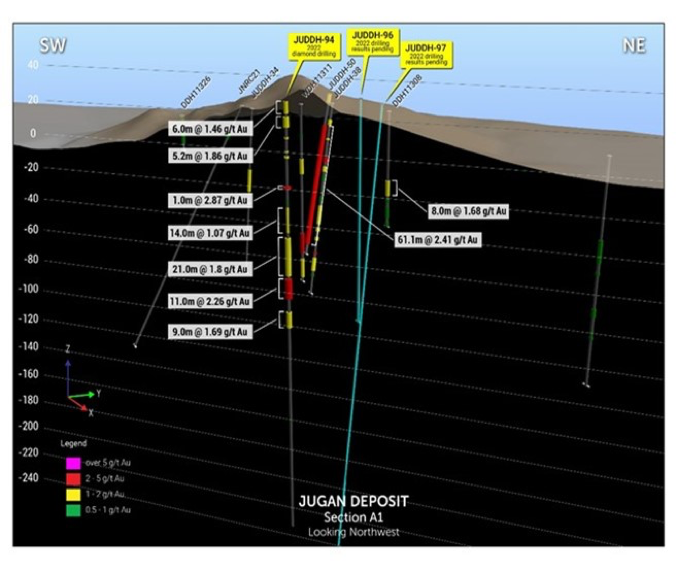

JUDDH-90 & -94 were deeper holes designed to investigate the potential multiple stacked shear zones that may be associated with deeper mineralisation, below the main Jugan footwall thrust. JUDDH-94 was drilled to a depth of 250m and although it intercepted 66m of mineralisation, all of this was located above the interpreted footwall thrust. The drilling results confirm that Jugan mineralisation abruptly terminates, coincident with the main footwall thrust. As such it represents an important boundary from a resource estimation standpoint. A post-drill revision of the Jugan Resource, to more precisely delineate this thrust, and its overlying counterpoint – the hanging wall thrust – together with the correlation of zones of high gold mineralisation commenced during the June Quarter.

Figure 6: JUDDH-94, showing intercepted mineralisation grades based on nominal 1m sample widths. JUDDH-94 intercepted substantial mineralisation, totally more than 66m including 11m @ 2.3 g/t.

Figure 6: JUDDH-94, showing intercepted mineralisation grades based on nominal 1m sample widths. JUDDH-94 intercepted substantial mineralisation, totally more than 66m including 11m @ 2.3 g/t.

Figure 7: Showing the location of JUDDH-94 relative to historical drilling. JUDDH-94 intercepted substantial mineralisation, totalling more than 66m- including 11m @ 2.3 g/t. Together with JUDDH-90, JUDDH-94 this is the first deep drilling in this area to investigate potential mineralisation.

Figure 7: Showing the location of JUDDH-94 relative to historical drilling. JUDDH-94 intercepted substantial mineralisation, totalling more than 66m- including 11m @ 2.3 g/t. Together with JUDDH-90, JUDDH-94 this is the first deep drilling in this area to investigate potential mineralisation.

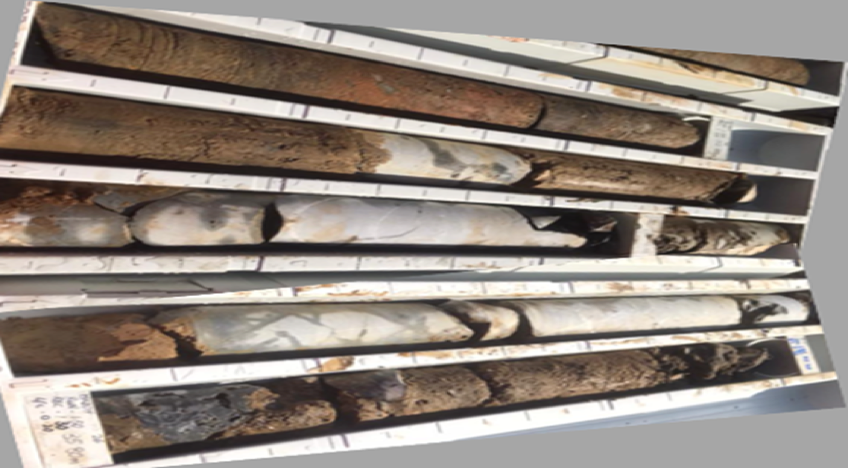

Figure 8: Core recovered from JUDDH-88 for portion of the interval 82m-88m @5.98 g/t Au, proximal to the interpreted footwall thrust.

Figure 8: Core recovered from JUDDH-88 for portion of the interval 82m-88m @5.98 g/t Au, proximal to the interpreted footwall thrust.

Visual sulphide mineralisation has been observed in core recovered from all holes. The sulphides at Jugan are dominated by arsenopyrite with subordinate pyrite, either as highly disseminated fine grain occurrences (mostly within shales) or associated within veining, stockworks, sand laminations and occasional breccia. Because gold mineralisation at Jugan is dominantly refractory, gold mineralisation is normally correlated with the presence of visible sulphides, whereas the occurrence of visible “free” gold in core is very rare. Figure 8 shows typical ore associated alteration for portion of JUDDH-88 between 82m—88m was assayed at an average grade of 5.98 g/t Au.

Figure 9: Perspective showing the inclined drill hole trajectories of JUDDH-93, allowing down-dip correlation between historical vertical drill holes, within the historical Resource wireframe nvelope (brown colouration).

Figure 9: Perspective showing the inclined drill hole trajectories of JUDDH-93, allowing down-dip correlation between historical vertical drill holes, within the historical Resource wireframe nvelope (brown colouration).

Flotation Scoping Study

Bulk samples of Jugan mineralisation were shipped to ZJH Minerals Company Ltd of Zingzen China during the Quarter for the purposes of flotation scoping study. This test work, involves crushing, grinding, conditioning, reagent responses, flotation, dewatering and drying for selected representative bulk samples from the Jugan Prospect. In conjunction with Dr Eric Devuyst, consultant metallurgist to Besra, and ZJH determined approximate processing stream, studies expected to be completed during the September 2022 Quarter. These results will be used to prepare a test report and flow chart for designing of up to a 200 TPD flotation plant currently under consideration for construction on site.

Jugan Environmental Impact Assessment

During the Quarter, Chemsain Konsultant Sdn Bhd continued its field work in order to satisfy the TORs which had been approved by the Sarawak National Resources and Environment Board during the March Quarter. This included the drilling of several hydrological test holes for ground water surveys (Figure 10). In addition, a LIDAR survey was flown to record detailed topographic information across Jugan’s development footprint.

Figure 10: Chemsain Kontract personnel undertaking hydrogeological monitoring as part of the Jugan EIA.

Figure 10: Chemsain Kontract personnel undertaking hydrogeological monitoring as part of the Jugan EIA.

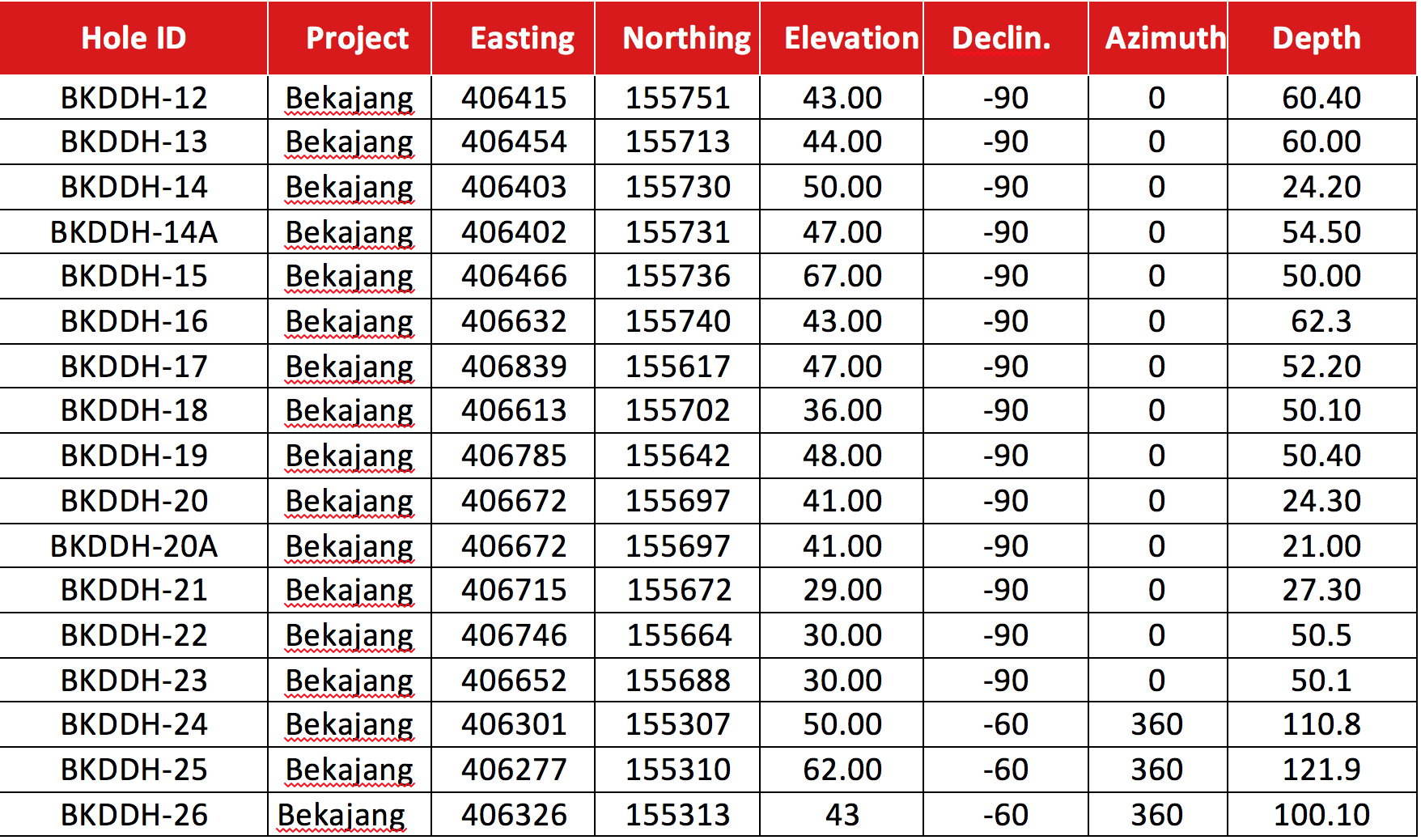

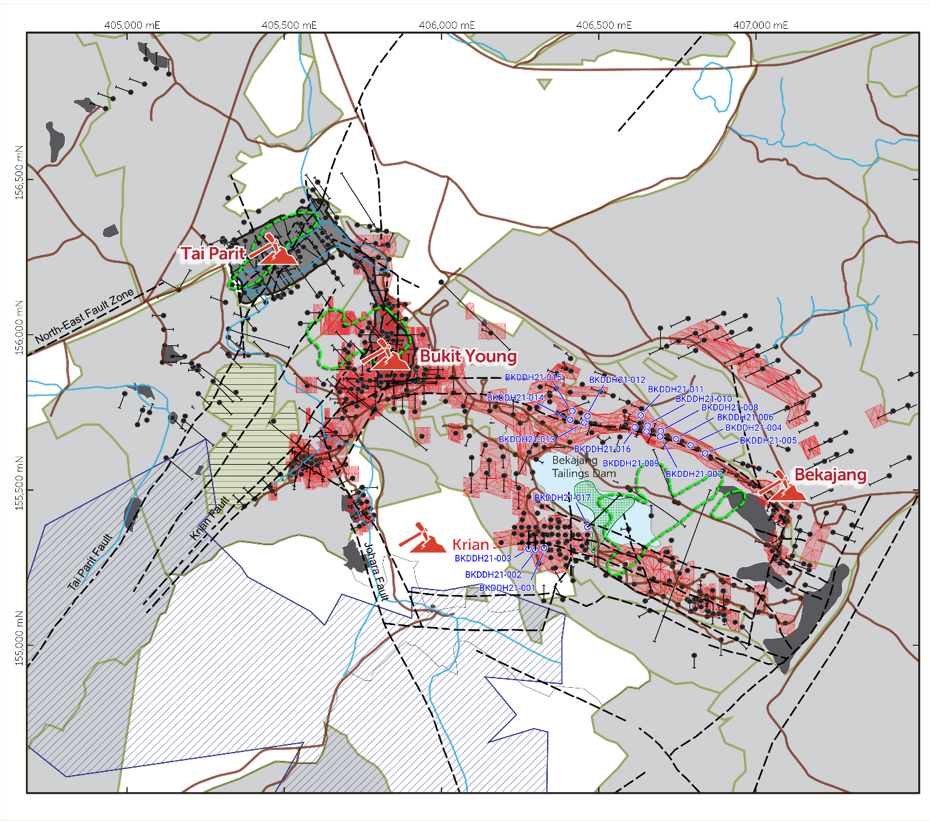

Bekajang Project

During the June 2022 Quarter drilling commenced on the Bekajang Project, following completion of drilling at Jugan. Bekajang is located 5km south of Jugan, and approximately 1km from Bau township (Figure 1). The initial program involved the drilling of 12 shallow fully cored holes (BKDDH-12 to -23) targeting extensions of the Bekajang Resource envelope. As defined by previous drilling, this Bekajang Mineral Resource has been estimated as:

- An Indicated Resource of 120,400 oz @ 2.02 g/t Au1,

- An Inferred Resource of 524,100 oz @ 1.53 g/t Au1; and

- An additional Exploration Target of 0.50 Moz – 0.80 Moz[8],[9] at 2.0 – 3.0 g/t Au.

Subsequently additional holes (BKDDH-24 – 30) were included to pursue deeper and higher-grade opportunities which were not targetted during historical, mainly RC, drilling.

The Bekajang Project lies in close proximity and along trend from two historical mines (Figure 3). The Bukit Young Gold Pit (BGY Pit) was mined until September 1992, prior to the redevelopment of the Tai Parit prospect, and according to Bukit Young mine records it had produced some 440,926 tonnes at a recovered grade of 4.51 g/t Au. The nearby Tai Parit mine has a reported production of some 700,000 oz of gold, which included approximately 213,000 oz @ 7 g/t produced by Bukit Young Gold mine Sdn Bhd (BGY) between 1991 and 1997 (Besra Gold Inc., 2013).

2021-2022 Drilling Program – Bekajang

The current drilling program for Bekajang is shown on Figure 12 and in Table 2. At the end of the June Quarter a total of 1047m of fully cored drilling had been completed involving 16 drill holes (BKDDH-12 to-27), with core samples for BKDDH-12 to -15 despatched for assaying.

The gold at Bekajang is associated mainly with pyrite and arsenopyrite sulphides, traditionally associated with hydrothermal alteration associated with the shale-limestone contact. However, core drilling has enabled the current program to already identify two previously unpursued targets, one involving highly altered clay dominated lithologies potentially being associated with non-refractory gold. The other, a highly altered zone within the Bau Limestone, lying substantially deeper than the traditional share-limestone boundary is associated with gold mineralisation within the Bekajang area.

Shale – Limestone Contact Mineralisation: The initial phase of drilling, BKDDH-12 to -23 targetted extensions of mineralisation associated the contact boundary between overlying shales and mudstones of the Pedawan Formation and the underlying Bau Limestone. Along the northern side of the tailings dam this boundary typically ranges between 5m and 35m depth. Ground conditions in this area are difficult, due to historic back-fill and presence of karstic cavities. Although no assay results have been received, as at the date of this Report, this drilling has provided the first comprehensive core coverage, the majority of historical holes being reverse circulation, providing only cuttings samples. Strong hydrothermal alternation textures have been observed to extend below the target mineralisation zone a pattern consistent in a number of holes suggestive of the nearby presence of a deep seated subvertical palaeo-conduit and potential target for a new, possibly high-grade mineralisation target (Figure 13).

Deep Weathering Karst Infill – targeting non-refractory gold

Drill holes BKDDH-24, -25 & -26 were drilled to approximately 100m depth to investigate the extent of heavily altered clay dominated karstic infill within the Bau Limestone (Figure 11) near the intersection of two fault trends. Again, the presence of this alteration texture was difficult to identify in previous RC drilling campaigns, however, this infill was associated with higher grade gold mineralisation at the BGY and Tai Parit mines. Importantly, in those mines that style of mineralisation is oxidised, and non-refractory, lending itself to more conventional leaching processes.

Visual inspection of the recovered core from BKDDH-24, -25 & -26 shows weathered clay mineralisation extending down to depths of up to 80 m. Because of the extent of weathering and potential masking of the presence of any sulphide mineralisation by the clay minerals, samples for these three holes will be fast tracked for assaying. If grades reminiscent of those encountered at the former Tai Parit mine are confirmed then this area will represent a previously unknown, and potentially significant new target for high-grade non-refractory mineralisation.

Figure 11: Portion of core retrieved at BKDDH-26 showing the highly altered clay dominated mineralisation within voids between competent intervals of Bau Limestone.

As shown on Figure 12 these three drill holes are located near a north-northeast structural offset identified on the geophysical coverage. This is the orientation of the Krian and Tai Parit faults which are implicated in controlling mineralisation at both the Tai Parit and BGY Pit mines. Extensive karst development in this area may reflect initial dissolution of limestone by migrating acidic hydrothermal fluids containing sulphides, especially along faults which promoted dilation and/or induced secondary permeability including veining and brecciation.

Figure 12: Location of the Bekajang Prospect. Current drilling program is shown in blue annotation. Both the Tai Parit and Bukit Young mines lie within approximately 1 km along trend to the northwest. The blue rectangle illustrates the boundary of EM airborne anomaly map shown highlighted in Figure 14. The Resource wireframes are shown in puce.

Figure 12: Location of the Bekajang Prospect. Current drilling program is shown in blue annotation. Both the Tai Parit and Bukit Young mines lie within approximately 1 km along trend to the northwest. The blue rectangle illustrates the boundary of EM airborne anomaly map shown highlighted in Figure 14. The Resource wireframes are shown in puce.

Sub-Vertical Conduits – targeting deeper, higher grade gold zones.

Surface mapping confirms that there is a conspicuous west-northwest structural grain through Bekajang and extending along strike through the former mine sites of the Tai Parit and BGY Pit. The widespread occurrence of mineralisation along shallow shale/limestone contact and the orientation of the resource envelope on the northern side of the tailings dam is highly suggestive that this mineralisation is sourced from a sub-vertical conduit system likely fault related and likewise trending west-northwest. The initial drilling results, coupled with a review of the historical drilling suggest a narrow linear conduit which could be characterised by deep

Figure 13: Section BKDDH-26, illustrating the intensely hydrothermally altered Bau Limestone, typical of textures endowed with higher grade gold mineralisation along trend at the former Tai Parit and BGY mines.

rooted body of mineralisation as a cast in the former conduit, which enabled upwelling hydrothermal fluids to provide sulphide endowment along the shallow Pedawan-Bau, shale – limestone, contact.

The fully cored drill holes of the current program are providing the first reliable data-set along this trend. Results to date indicate zones of far deeper hydrothermal alternation (Figure 13) consistent with the sub-vertical conduit proposal. As a result, drilling of additional deep drill holes during the coming Quarter tare intended to delineate the presence and geometry of this feature. During June 2022, BKDDH-27 was partially completed and the texture of the underlying Bau limestone is in places highly silicified and brecciated, reminiscent of higher-grade gold endowment found in the Tai Parit and Taiton areas.

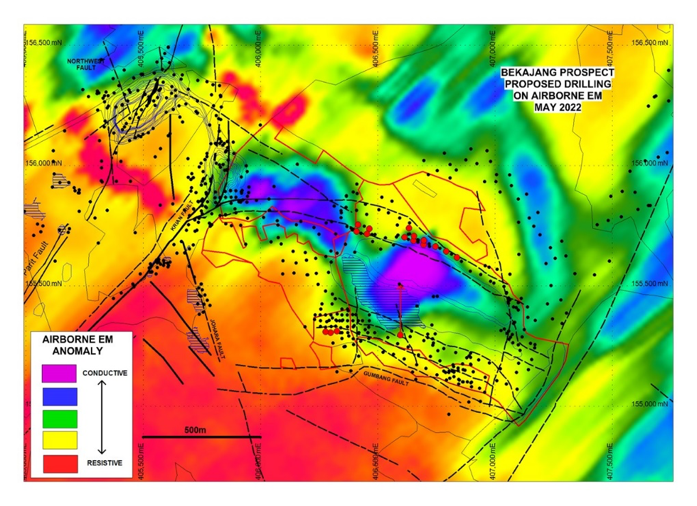

Figure 14 shows an airborne EM (450 Hz channel) anomaly map, with colour stretch, draped over the concessions and drill collar locations. The red/orange colours reflect high resistivity rock units whereas the blue/purple colours reflect low resistivity (high conductivity) rock units.

This EM coverage reveals a distinctive central conductive zone at depth to be located beneath Bekajang, offset in a right-lateral sense across a northeast trending broad lineation, which coincidently is mirrored by an offset in the overlying Resource wireframes. This association suggests the lineation may be implicated in controlling Bekajang mineralisation. The trend may be the locus for preferential sub-vertical migration pathways, allowing metal charged hydrothermal fluids, sourced from underlying intrusives, to penetrate the overlying host rock sequences, enabling endowment along the shale and limestone contact boundaries at shallow depth. This north-northeast cross trend lies parallel to the Krian and Tai Parit fault trends which, to the immediate west, are locally associated with mineralisation at Tai Parit and the Bukit Young pits. Deep exploration holes are planned in the future with the objective of intersecting the northwest trend and the conductivity anomalies in order to establish their mineralisation potential.

Figure 14: Showing airborne EM survey across the Bekajang Prospect, illustrating the strong central conductivity anomaly beneath the shallow Bekajang Resources. Dashed line shows a conspicuous offset in the anomaly, and is mirrored in overlying resource wireframes.

Figure 14: Showing airborne EM survey across the Bekajang Prospect, illustrating the strong central conductivity anomaly beneath the shallow Bekajang Resources. Dashed line shows a conspicuous offset in the anomaly, and is mirrored in overlying resource wireframes.

During the June 2022 Quarter, approximately 1,083m of fully cored drilling was completed, all of which with the exception of 64m drilled at Jugan, was undertaken within the Bekajang area.

Assaying

During the June 2022 Quarter assay results for the for batches three and four (for Jugan drill holes JUDDH-89 to 94, inclusive) were received and released to the market. Assay results for core samples for JUDDH-95, and 97, 98 shipped to SGS’s laboratories at Pt Klang during the Quarter are pending. Since the end of the Quarter core samples have been despatched for the initial Bekajang drilling – BKDDH-13 to 27, with samples for BKDDH-23, 24, 26, & 27 fast-tracked for analysis.

Stakeholder Relations

During the June Quarter a meeting was held with leaders of the Pisa kampong, which occupies a major portion of the Pejiru region. Discussions were cordial and included future intensions of Besra to undertake work within its concessions in that area.

In June 2022 Besra was able to present to a meeting of the JMG, the federal government body, equivalent of the Department of Mineral Geology, which was meeting in Kuching. Besra was pleased that JMG representatives, including the Deputy Director of JMG, accepted an invitation to visit its Bau facilities where presentations were provided on current drilling program, Bau prospectivity and the protocols used for Quality Assurance and Quality Control of core sample handling, processing, and assaying in order to meet the international requirements of both NI 43-101 and JORC 2012 requirements.

ACTIVITY OUTLOOK FOR THE NEXT QUARTER

Jugan Prospect

Review of the geological model will continue with results for the outstanding drilling results to be incorporated into a revision of the geological model for the main body of Jugan mineralisation.

Ground water studies and continued progress of the EIA at Jugan are expected to continue and be completed or nearly completed during the September Quarter.

Flotation results for bulk samples at Jugan are anticipated during the September Quarter from HZJ.

Bekajang Prospect

Because of the substantial backlog of drilling results, including results which will be critical for designing future drilling priorities, it has been decided to temporarily cease drilling from the end of July. This will enable results to be assessed once assays are received and planning of a future drilling program to be planned with an appropriate budget based around future capital raisings.

Corporate

On 30 June 2022, the Company held cash reserves of $1.199 million and no debt.

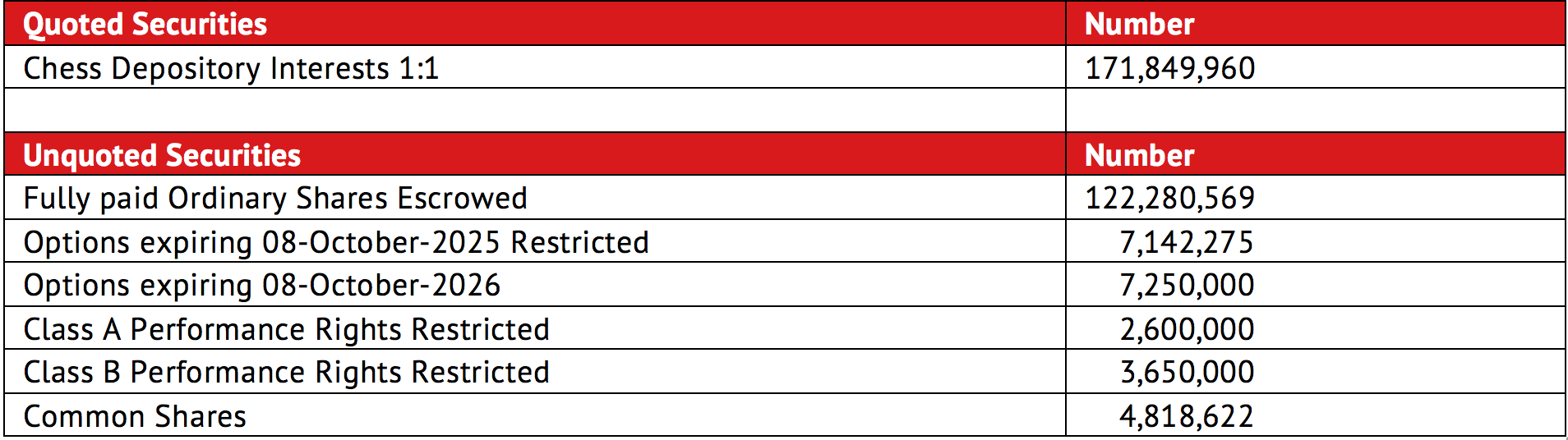

Securities on issue on 30 June 2022 were:

Additional ASX Listing Rule Disclosures

ASX Listing Rule 5.3.1 – payments for direct exploration expenditure during the quarter totalled $1.053 million.

Details of the exploration activities undertaken during the June 2022 quarter are as noted in this Activities Report.

ASX Listing Rule 5.3.2 – the Company confirms there were no mining production and development activities undertaken during the June 2022 quarter.

ASX Listing Rule 5.3.3 – there were no changes to Besra’s interests in the Bau Gold Project at 30 June 2022.

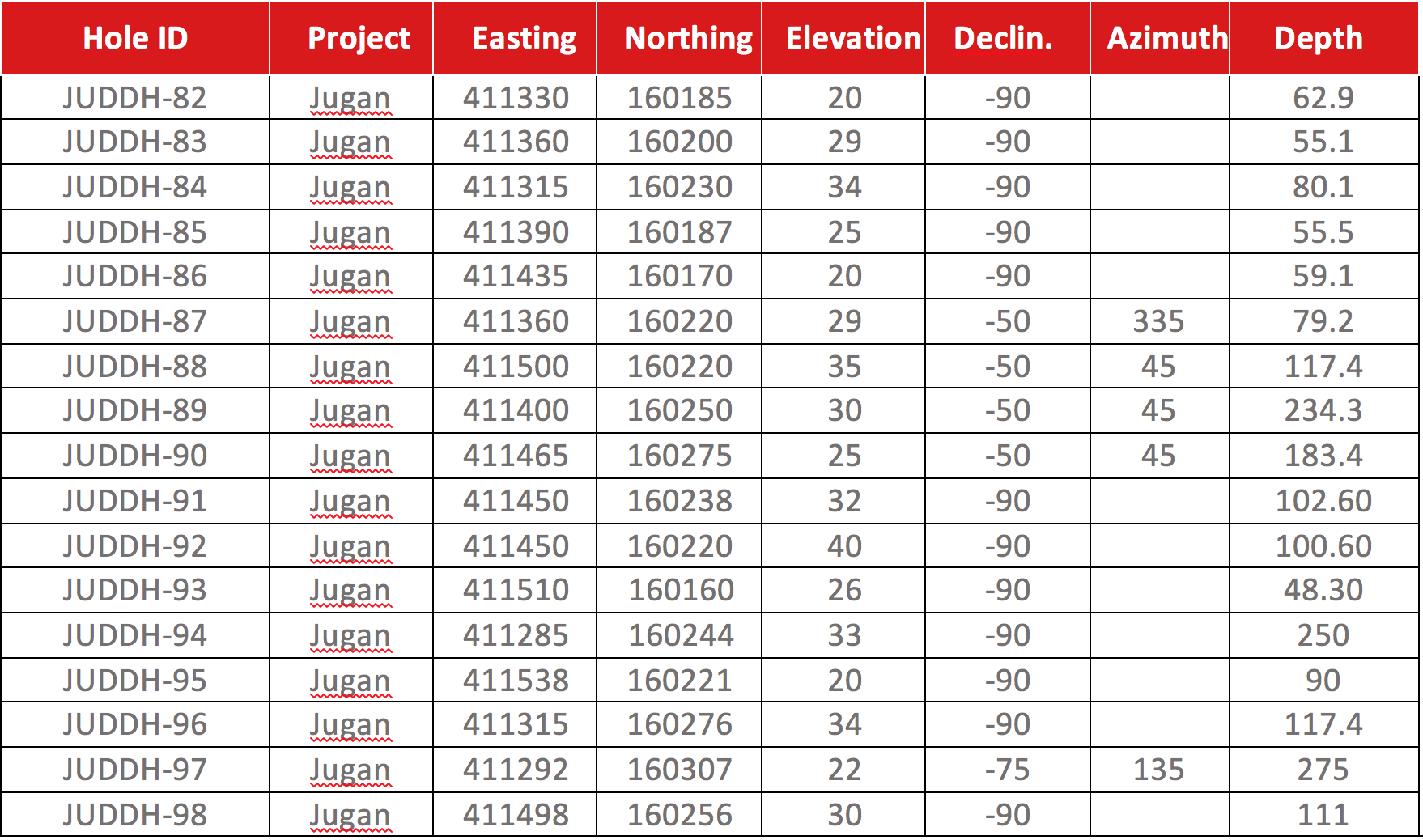

ASX Listing Rule 5.3.4 – Besra provides the following information with respect to its actual expenditure as of 30 June 2022 versus its “use of funds” statement as set out in its Prospectus and its actual expenditure since ASX admission.[10]

Activities at the Bau Gold Project continued during the June 2022 Quarter focused on the Bekajang and Jugan Prospects. This included progress on an EIA for the Jugan Prospect.

Besra’s business operations will slow over the coming six months and, in this period expects to be able to secure additional funding to progress the exploration and development of the Bau Gold Project.

ASX Listing Rule 5.3.5 – payments to related parties during the Quarter as outlined in sections 6.1 and 6.2 of the Appendix 5B consisted of the following:

Non-executive director fees included in staff costs for services provided during the quarter totalled $59,000 are included in 1(d) of Appendix 5B.

Executive director fees for services provided during the quarter and capitalised to exploration and evaluation costs totalled $41,000 are included in 2.1(d) of Appendix 5B.

As outlined in the Company’s Prospectus, certain directors had accrued director fees for the financial years up to and including 30 June 2021 and through to 30 September 2021. Amounts totalling $62,000 were paid during the quarter in part settlement of amounts due and are included in outlays at 3.9 of Appendix 5B. In addition, as outlined in section 9.7 of the Prospectus, amounts due on working capital loans to certain directors were repaid during the quarter and included at 3.9 of Appendix 5B.

This ASX release was authorised by the Audit Committee of Besra Gold.

For further information:

| Australiasia | North America |

| Ray Shaw Chief Executive Officer Email: ray.shaw@besra.com |

James Hamilton Investor Relations Services Mobile: +1 416 471 4494 Email: jim@besra.com |

Competent Person’s Statement

The information in this Announcement that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr. Kevin J. Wright, a Competent Person who is a Fellow of the Institute of Materials, Minerals and Mining (FIMMM), a Chartered Engineer (C.Eng), and a Chartered Environmentalist (C.Env). Mr. Wright is a consultant to Besra. Mr. Wright has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code (2012 Edition) of the Australasian Code for Reporting of Exploration Results, and a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

Kevin J. Wright consents to the inclusion in this Announcement of the matters based on his information in the form and context that it appears.

Disclaimer

This Announcement contains certain forward-looking statements and forecasts concerning future activities, including potential delineation of resources. Such statements are not a guarantee of future performance and involve unknown risks and uncertainties, as well as other factors which are beyond the control of Besra Gold Inc. Actual results and developments may differ materially from those expressed or implied by these forward-looking statements depending upon a variety of factors. Nothing in this Announcement should be construed as either an offer to sell or a solicitation of an offer to buy or sell securities.

Unless otherwise indicated, all mineral resource estimates and Exploration Targets included or incorporated by reference in this Announcement have been, and will be, prepared in accordance with the JORC classification system of the Australasian Institute of Mining and Metallurgy and Australian Institute of Geoscientists.

Disclosure

The Pejiru Sector lies within MC/KD/01/1994 which has been pending renewal for a number of years. As outlined in the Malaysian Solicitor’s Report on Title (Attachment G) of the Replacement Prospectus of Besra dated 8 July 2021, until a decision is made, the intention of section 48(9) of the Minerals Ordinance is to enable mining activities to continue on a pre-existing licence, in those prior lands of MC/KD/01/1994, until a determination of the renewal is made.

The information in this announcement is based on the following publicly available announcements previously lodged on the SEDAR platform which are available on https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00001815 or on Besra’s website www.besra.com.

- Besra Gold Inc Bau Gold Project Sarawak Malaysia Exploration Target Inventory. Lodged SEDAR Platform Feb 26, 2021;

- Besra Bau Project – Mineral Resource and Ore Reserve Updated to JORC 2012 Compliance. Lodged SEDAR Platform Nov 22, 2018;

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

[1] Refer Prospectus dated 8 July 2021, Section 3.11 and Attachment G.

[2] Jugan Exploration Target ranges between 2.0 – 3.2 million Oz based on a range of grades of 1.82 – 2.50 Au g/t, refer Prospectus dated 8 July 2021.

[3] The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

[4] Refer Prospectus dated 8 July 2021, Section 3.11 and Attachment G.

[5] Jugan Exploration Target ranges between 2.0 – 3.2 million Oz based on a range of grades of 1.82 – 2.50 Au g/t. The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

[6] Jugan Exploration Target ranges between 4.9 Moz – 9.3 Moz based on a range of grades of 1.82 – 2.50 Au g/t.

[7] The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

[8] The Bekajang Exploration Target ranges between 8 – 9 million tonnes based on a range of grades of 2 – 3 g/t Au.

[9] The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

[10] Forecast expenditure classifications used in the Prospectus may differ from the classifications used in the Appendix 5B.