ASX ANNOUNCEMENT

31 January 2024

ASX : BEZ

HIGHLIGHTS

- Cash of A$33.2m at 31 December 2023, following the receipt of payments from Quantum under the US$300m Gold Purchase Agreement (GPA) with a further US$9.8m to be received and up to US$265m headroom remaining

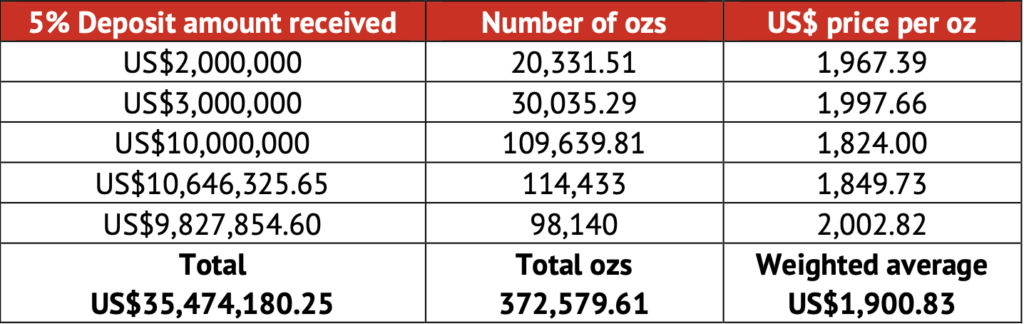

- 372,580 ounces of gold have been contracted for purchase by Quantum pursuant to the GPA, at a weighted average sale price of U$1,900.83 per ounce

- First gold concentrate produced from Jugan deposit, showing excellent characteristics consistent with prior testing

- Jugan Pilot Processing Plant equipment consignment from Chinese manufacturers, construction phase to begin in Q1 calendar 2024

- Exploration drilling continues within Jugan precinct, assays pending

- Groundwork commenced for future exploitation of Bekajang bonanzagrade mineralisation

- Board anticipates a material increase in the tempo of activities at the Bau Project in 2024 with respect to drilling activity and advancing the Definitive Feasibility Study

- Additional management hires and consulting support engaged by the Board

The Board of Besra Gold Inc (ASX: BEZ) (Besra or the Company) is pleased to provide this Quarterly Activities Report for the quarter ended 31 December 2023 (Quarter), which accompanies the Quarterly Cash Flow Report.

Significant Cash Position

During the Quarter the Company received US$20.6m from Quantum Metals Recovery Inc (Quantum) as well as advice of a further remittance by Quantum of US$9.8m. These payments represent the first three draw-downs pursuant to the terms of the Gold Purchase Agreement (GPA) approved by shareholders on 25 July 2023. This funding places the Company in an enviable financial position to fund its objective of bringing the Bau Gold Project (Bau) into full-scale development.

As previously noted[1], the GPA involves the Company selling to Quantum a quantity of refined gold from the Bau Gold Project (or any other gold project owned by the Company or its subsidiaries at any time) until:

• 3,000,000 ounces of refined gold has been received by Quantum; or

• aggregate deposits in an amount equivalent to US$300,000,000 (Facility) have been received by the Company from Quantum.

The Facility is not debt, it is interest free and is expected to remove the need for dilutive equity financing and project/corporate debt that would otherwise encumber Besra with hedging requirements and/or onerous covenants. The total number of ounces contracted for purchase by Quantum pursuant to the GPA and the agreed contracted gold price for each of the Quantum purchases is as set out below:

Jugan Project

First Gold Produced

During the Quarter, gold concentrate was produced by Besra for the first time from the Jugan mineralisation, satisfying an obligation with Quantum pursuant to the GPA to produce gold in mineral concentrate by no later than 31 December 2023 from the Bau Project.

As outlined in an ASX announcement dated 22 December 20232, random bulk samples of mineralisation from the Jugan Project site were processed at a third-party processing facility, chosen for its specific capability to process the same style of refractory gold mineralisation found at Jugan.

The processing involves two stages: Stage 1 “bench-scale” testing, involved 1.3 tonnes of bulk samples, which were subject to trials to ascertain gold deportment responses and content of arsenic levels; and Stage 2 involving up to 9 tonnes of bulk samples in trial pilot plant processing.

Stage 1 results were encouraging with two sets of tests (A & B) providing concentrate grades, after cleaning, of 47.28 g/t and 46.18 g/t, based on head grades of 5.59 g/t and 5.57 g/t respectively[2]. The ratios of concentrate enrichment and the relationship between gold grade and arsenic content determined during the Stage 1 trials were entirely consistent with processing trials previously conducted, using smaller sample sizes, at a number of third- party off-site locations leading up to the preparation of the 2013 feasibility study.

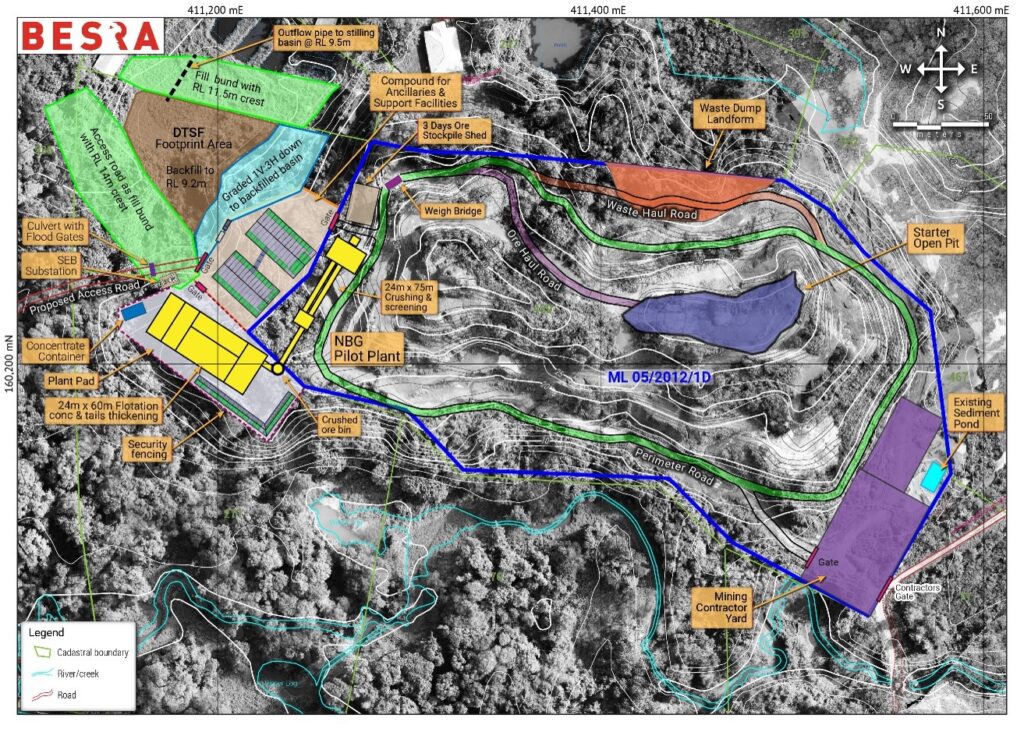

Figure 1 – Proposed Jugan Pilot Plant site design, superimposed onto topography & grey-scale Landsat imagery

[1]Refer ASX Release “US$10,000,000 received from Quantum”, dated 11 October 2023.

[2]ASX announcement “Besra Produces First Gold Concentrate”, dated 22 December 2023.

Stage 2 trial processing (which is still in progress) is adopting the processing sequence determined as a result of Stage 1 studies to evaluate the consistency of results for larger samples.

Jugan Pilot Plant Activities

During the Quarter, key activities included progression of equipment fabrication, finalisation and submission to authorities of base-line surveys and the preparation of Feasibility Study and Mine Rehabilitation Reports for independent assessment of the plant details (Figure 1), as required by local authorities.

Fabrication of the first of two shipments of processing equipment, designed for a nominal 50 tonnes per day throughput, was completed by the contractor Yantai-Jenping Machinery Co of China (Yantai). Consignment of this first shipment to Kuching is scheduled for 30 January 2024. Prior to packaging, consignment representatives of Besra, including an independent consulting engineer, visited Yantai’s facilities to undertake a quality assurance and quality control inspection.

Visual inspection of the works performed to date were observed to be of good workmanship and fully compliant with Yantai’s ISO 9001 accreditation. All materials we found to meet the design specifications.

Yantai is proceeding with the second, and final, batch of equipment which is expected to now be completed during February 2024. Yantai will provide the necessary specialist personnel to come to site and assist with the construction, commissioning and training phases.

During the Quarter, some modifications to the plant design were made to facilitate easier land access and geotechnical surveys of soil and substratum were completed in order to confirm suitability for civil and structural construction of plant components. Besra expects the first consignment of processing equipment to arrive at site in the current quarter followed by the second consignment in late Q1, calendar 2024. The Company is targeting construction of the Pilot Processing Plant to commence during Q1, calendar 2024 with first production results anticipated early in quarter two.

Jugan Precinct Drilling

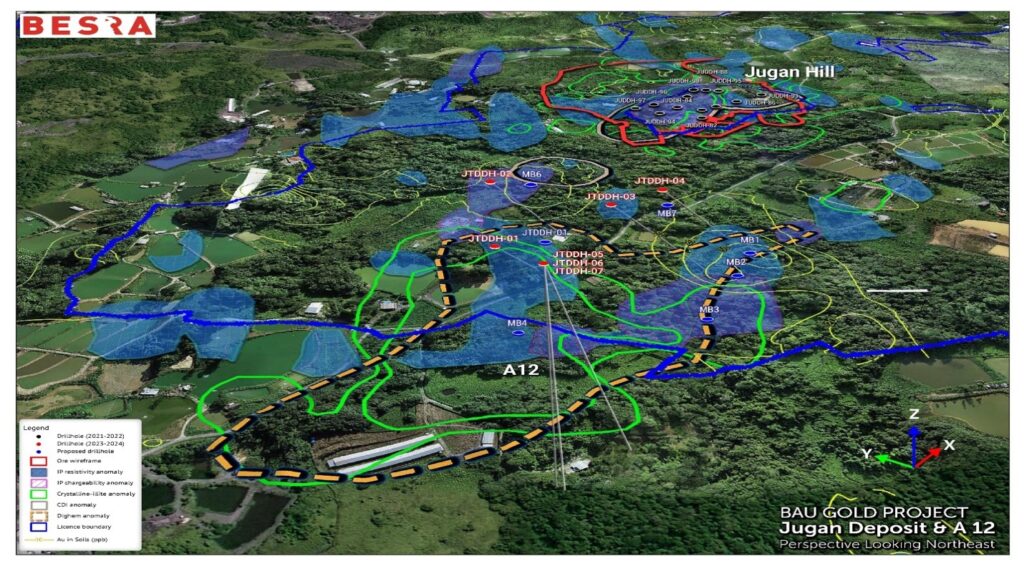

Exploration drilling activities continued in the Quarter consisting of diamond core holes JTDDH 105 & 106 which were completed and core samples sent for assay (Figure 2).

Figure 2 – Geophysical and geological anomalies in the area surrounding Jugan Prospect together with the locations of JTDDH-101 to 107.

Although final assay results have not been received, visual inspection of the core continues to confirm that the geology and associated mineralisation display much greater variability than at the nearby Jugan Prospect. This is consistent with a more defocused distribution of anomalies, compared to the signature across the Jugan Prospect. Initial indications are that there appears to be a greater association with intrusives and fault related brecciation than at Jugan. Likewise, the sulphide mineralisation appears finer grained and disseminated, pyrite being more dominant than arsenopyrite.

This drilling is expected to provide information on what rock attributes are associated with the various geophysical anomalies, as well as surface geochemical anomalies.

Bekajang: Groundwork for future exploitation bonanza grade mineralisation

Following the discovery of exceptional and bonanza grade gold, including free-gold, below an already recognised target at the shallow Limestone-Shale contact, Besra will commence the necessary groundwork for future exploitation. Initially this entails lodgement of a feasibility study, rehabilitation study and Environmental Impact Assessment (EIA) based on the proposed development. Mimicking the approach for the Jugan Pilot Plant, the Company is initially proposing a trial pit with site crushing and loading facilities to take representative bulk ore samples from Bekajang to the Jugan’s processing centre for processing, some 7 km away.

This is an attractive approach both in terms of minimising the site’s development impact as well as utilising, to the full extent, the Company’s new development assets at Jugan, where trials for processing will be undertaken.

These trials will feed into a comprehensive evaluation of Bekajang’s capacity to support a future commercial operation, most likely the second for the Company within the Bau Goldfield corridor.

Preliminary mine site design has been undertaken by Snowden Optiro, a highly respected premier mining advisory service which has previously worked on the Jugan Project.

The Bekajang Project lies along a very prospective trend that includes two historical mine sites. The Bukit Young Gold pit was mined until September 1992, prior to the redevelopment of Tai Parit that, according to mine records, produced some 440,926 tonnes at a grade of 4.51 g/t Au. Tai Parit recorded production of some 700,000 oz of gold, of which approximately 213,000 oz @ 7 g/t was produced between 1991 and 1997 by Bukit Young Gold Mine Sdn Bhd, the last commercial operator within the Bau Gold Field corridor.

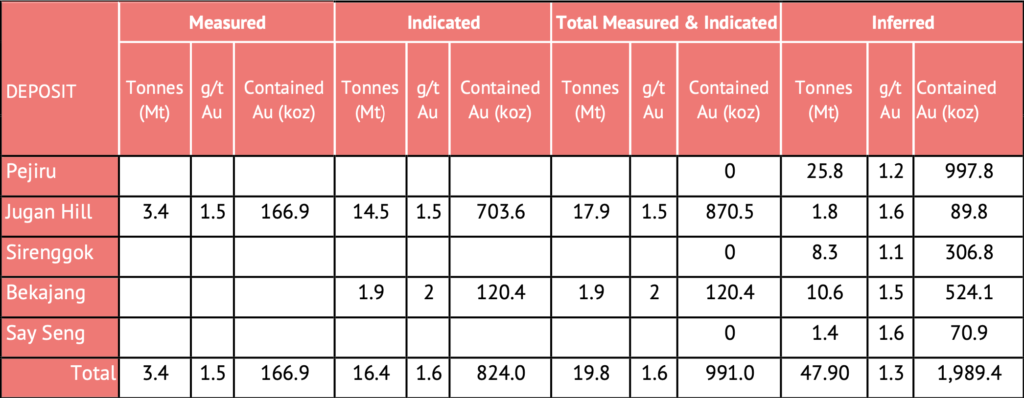

Historical drilling provides the basis for a substantial JORC 2012 compliant Resource inventory at Bekajang (Table 1), comprising:

- a Measured and Indicated Resource totalling 120.4 koz @ 2.0 g/t Au; and

- an Inferred Resource of 524 koz @ 1.5 g/t Au.

Corporate

During the Quarter, John Seton stepped down as a Director. Quantum appointee to the Board, Kenny Lee (appointed 27 September 2023) is based in Melbourne and is acting in an executive capacity (on a day to day basis) to ensure the smooth establishment and recruitment of key operational staff in Melbourne, where Besra is currently consolidating both its corporate and administrative functions.

The Company Secretarial role during the Quarter was broadened with Mike Higginson accepting the added full time responsibility as the Company’s Chief Corporate Officer. This was initiated to ensure both regulatory, statutory and governance matters, together with a focus on commercial and corporate matters were prioritised. Also during the Quarter, Noblemen Ventures Pty Ltd a dedicated corporate advisory group who were instrumental in Besra’s past capital raisings and very importantly the introduction of Quantum and the establishment of the GPA, was formerly engaged in November to assist and advise the Board and management on a variety of corporate and investment matters.

During the Quarter, Besra terminated the agreement with Pangaea Resources Limited to acquire 1,802 shares (NBG Shares) in the issued share capital of North Borneo Gold Sdn Bhd (NBG), the holding company of the Bau Gold Project, due to the conditions precedent not being satisfied by the due date. Post Quarter, Besra completed the acquisition of those 1,802 NBG shares in a separate transaction with the Gladioli Group, on terms more favourable to Besra. Besra’s equity in the Bua Project has now increased to 93.55%.

Future Activities

With its strong and growing cash position, the Company is now in an enviable position to execute its 2024 activities without reliance on equity market funding. The Company expects 2024 to be characterised by an increase in tempo in drilling activity, work to complete the Definitive Feasibility Study (DFS), hires across senior executive and technical roles as well as an expanded Board to guide the Company through the development and production phases of the Bau Project.

Key focus areas include:

- Board and Senior Management – During the Quarter, John Seton stood down as a Director. As the Company moves into the development phase at Bau, the Board recognises that there will be a requirement to introduce diversity and experience with additional Directors to be appointed to the Board. The Company anticipates a Board comprised of five or six Directors, with one being an Executive Director. In mid-2023, Besra commenced a recruitment search for a suitable Chief Executive Officer. Whilst the Board has reviewed several candidates, it has not yet finalised an offer with a candidate.

- Jugan Commercial Definitive Feasibility Study – Focused on a revision of the earlier 2013 feasibility study, it will incorporate the trial processing results of the Jugan Pilot Plant bulk sample test. External, internationally recognised, mining consultants will be appointed in the near term to oversee this DFS process which will leverage off not only the 2013 feasibility study, but the skills amassed during the EIA process completed in 2021 for the successful development approval of the Jugan Pilot Plant Project. The DFS is targeted for completion in early 2025.

- Mineralisation Habitat – Initiated during 2023, studies by international experts of the relevance of recent advances in the understanding of refractory gold mineralisation globally, to that within the Bau Gold Field corridor will continue in 2024. Results are expected during Q1 calendar 2024, noting that these studies are likely to be on-going. Already proof of concept of some new models has been verified, consistent with the discovery of exceptional and bonanza grade gold intersected at Bekajang. Similar potential is anticipated at other sites along the length of the Bau Goldfield corridor. Metal zonation and petrologic studies related to mineral paragenesis will be pursued during the course of 2024 to better understand the overall gold endowment within the corridor.

- Expanded Drilling Program – Drilling will be ramped up during 2024 to at least3 rigs, targeting resource conversion at Pejiru, Bekajang and Sirenggok to upgrade JORC (2012) Measured and Indicated JORC classification inventories as well as the pursuit of recent advances in our understanding of likely locations for free-gold potential. Drilling will also be targeted to challenge some of the pre-conceived notions of the region’s gold mineral endowment, including the potential for an underground component within the Jugan Project which may provide scope for additional recovery of mineable resources. More details on the precise scope of planned drilling in 2024 will be released in due course.

- Recruitment – In Besra’s Malaysian office, an Environmental Manager was engaged during the Quarter. Further recruitment will be undertaken to provide necessary support for an increase in the tempo of activity in 2024. In keeping with its environmental, corporate and social governance policies, local recruitment will be preferenced and in this regard Sarawak has a remarkable pool of skills and talent. The Company, through its local operations vehicle NBG, intends to make recruitment placements for its mining engineering, chemical assay laboratory, geological and support staff requirements, to ensure that, together with local contractor service providers, it has a dedicated team able to achieve its objectives totally familiar with local community and broader stakeholder issues.

- Rationalisation of Mining Concessions– As announced on 24 January 2024[3] Besra continues to consolidate its interests in the Bau Project, having now increased its ownership in NBG by 0.72% to 98.5%. On an equity adjusted basis, this represents an increase in Besra’s interest in Bau of 0.78% to 93.55%.

-

- Besra has further triggered its contractual rights to have the concessions transferred from its Joint Venture partner, the Gladioli Group, to its majority owned NBG as a precursor to future concession rationalisation; seeking to create a far simpler concession framework facilitating and minimising both operational and administrative overheads.

- This will also provide an opportunity to revitalise, with the relevant authorities, what in some instances have been long outstanding renewal processes.

BACKGROUND TO BAU GOLD PROJECT

The Bau Gold Project is located 30km – 40km from Kuching, the capital city of the State of Sarawak, Malaysia, on the island of Borneo (Figure 3) and centred on the township of Bau.

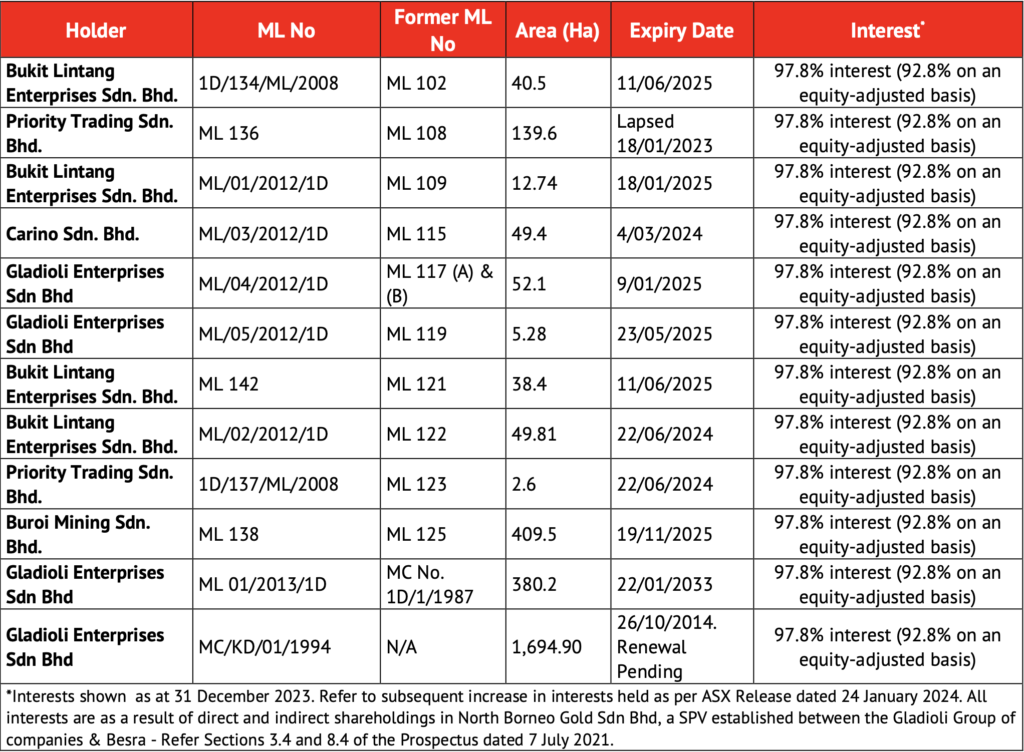

Besra controls, directly and indirectly, a 97.8% interest (92.8% on an equity adjusted basis) of the Bau Gold Project. This project lies at the western end of an arcuate metalliferous belt extending through the island of Borneo. In Kalimantan, the Indonesian jurisdiction portion of Borneo Island, this belt is associated with significant gold mining areas including Kelian (7 Moz) and Mt Muro (3 Moz).

Figure 3 – Location of Bau Gold Project. Inset shows tenement interests within Sarawak and location of metalliferous belt traversing the island of Borneo (in red).

The Bau Gold Project is defined by a gold bearing mineralisation system covering approximately an 8km x 15km corridor. Within this corridor Besra has identified JORC (2012) Resources across a number of discrete deposits of Measured 3.4 Mt @ 1.5g/t Au for 166.9koz, indicated 16.4 Mt @ 1.57g/t Au for 824.8 koz and Inferred 47.9 Mt @1.29 g/t Au for 1,989 koz (Table 1). In addition, the Project has a global Exploration Target ranging between 4.9 Moz and 9.3 Moz[4],[5] (on a 100% basis). The region is well serviced by infrastructure including ready access to deep water ports, international airport, grid power, communications and a multitude of service providers.

Mineral licences in which the Company has an interest are shown in Appendix A.

Table 1– JORC 2012 Compliant Resources for the Bau Gold Field Project[6].

**The potential quantity and grade of an Exploration Target is conceptual in nature, there has been insufficient exploration todetermine a Mineral Resource and there is no certainty that further exploration workwill result in the determination of MineralResources or that the production target itself will be realised

[3] Refer ASX release dated 24 January 2024 “Besra Increases Ownership in Bau Gold Project”

[4] Refer Prospectus dated 8 July 2021, Section 3.11 and Attachment G.

[5] Jugan Exploration Target ranges between 2.0 – 3.2 Mil Oz Au based on a range of grades of 1.82 – 2.50 g/t Au. The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

[6] Updated to include an impairment following the expiry of Ex-ML 136, as announced to the ASX on 20 January 2023.

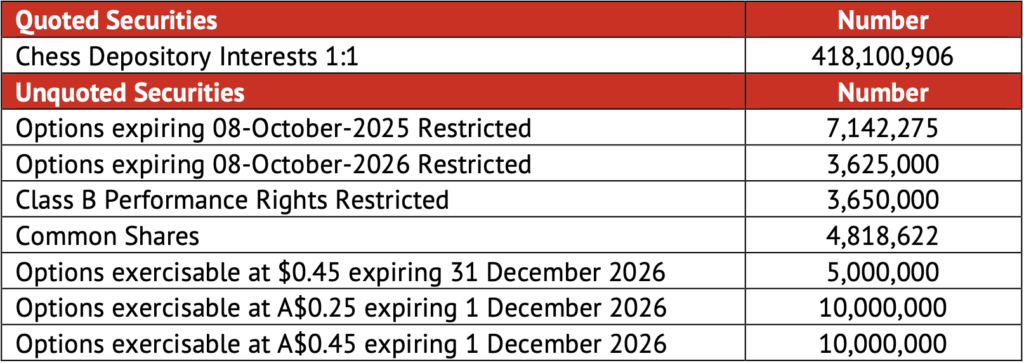

Capital Structure

Additional ASX Listing Rule Disclosures

ASX Listing Rule 5.3.1 – Payments for direct exploration expenditure during the Quarter totalled $1,283k (YTD $2,553k.)

ASX Listing Rule 5.3.2 – The Company has not yet commenced mining production, however, has commenced development activities with planning, purchasing and logistics of its Pilot plant.

ASX Listing Rule 5.3.3 – During the Quarter Besra increased its ownership of the Bau Gold Project as a result of the acquisition of a further 1,802 shares (0.72%) in North Borneo Gold Sdn Bhd (NBG) (the owner of Bau) from Gladioli Enterprises Sdn Bhd for A$500,000. Because of this transaction, Besra’s beneficial ownership of NBG has increased by 0.72% to 98.5%. On an equity adjusted basis, this represents an increase in Besra’s interest in Bau Gold Project of 0.78% to 93.55%.

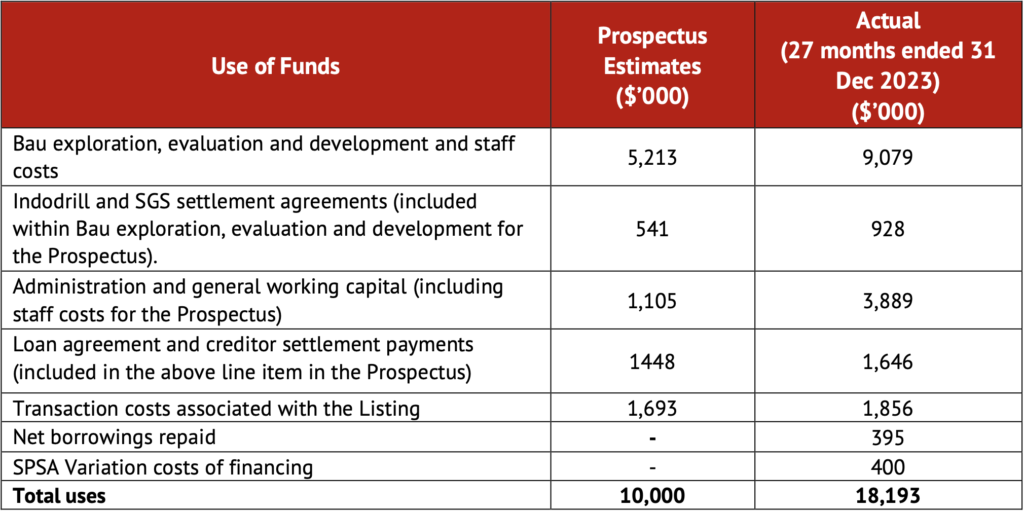

ASX Listing Rule 5.3.4 – Besra was admitted to the official list of the ASX on 8 October 2021 following completion of an IPO raising. The current Quarter is included in a period covered by the use of funds statement in the IPO prospectus lodged with ASX under Listing Rule 1.1 condition 3.

A comparison of the Company’s actual expenditure up to December 31, 2023, on the individual items in the “use of funds” statement since the date of its admission to the official list, with those estimated expenditure on those items in the “use of funds” statement in the Company’s prospectus, is set out below as required by ASX Listing Rule 4.7C.2.[7]

[7] Forecast expenditure classifications used in the Prospectus may differ from the classifications used in the Appendix 5B.

Table 2 – Comparison of actual expenditure to date.

Because of superior drilling results at Jugan and the interception of bonanza grade mineralisation during Bekajang exploration and resource evaluation, administration and general working capital expenditures have increased relative to those which had been estimated prior to listing and the commencement of drilling.

The Company notes:

- New capital was received within the first year since admission to expedite the Bau Project, following the positive results from the 2022 drilling programs. In October 2022, $1,000,000 was raised from a placement with the Company’s Substantial Shareholder, Quantum Metals Recovery Inc (“Placement”). This supplemented by further capital received on 3 January 2023 under an Entitlement Offer.

- In addition, funding totalling $39.8m was received under the Gold Purchase Agreement commencing July 2023 to December 2023.

- Activities at the Bau Project continued during the Quarter focused on the Bekajang and Jugan Projects. This included forward drilling proposals within the Bekajang Project and on-going design and preparatory and letting of contracts for construction and commissioning of a test pit and pilot plant at Jugan.ASX Listing Rule 5.3.5 – payments to related parties during the Quarter as outlined in sections 6.1 and 6.2 of the Appendix 5B consisted of the following:

- Non-executive director fees included staff costs for services provided during the Quarter totalled $45k are included in 2.1(d) of the attached Appendix 5B.

- Executive director fees for services provided during the Quarter and capitalised to exploration and evaluation costs amounted to $76k are included in 2.1(d) of the attached Appendix 5B.

For further information:

| Australasia | North America |

|

Ben Henri Media + Capital Partners Mobile +61 473 246 040 Email; ben.henri@mcpartners.com.au

|

James Hamilton

Investor Relations Services Mobile: +1 416 471 4494 Email: jim@besra.com |

Competent Person’s Statement

The information in this Announcement that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr. Kevin J. Wright, a Competent Person who is a Fellow of the Institute of Materials, Minerals and Mining (FIMMM), a Chartered Engineer (C.Eng), and a Chartered Environmentalist (C.Env). Mr. Wright is a consultant to Besra. Mr. Wright has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code (2012 Edition) of the Australasian Code for Reporting of Exploration Results, and a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. Kevin J. Wright consents to the inclusion in this Announcement of the matters based on his information in the form and context that it appears.

Disclaimer

This Announcement contains certain forward-looking statements and forecasts concerning future activities, including potential delineation of resources. Such statements are not a guarantee of future performance and involve unknown risks and uncertainties, as well as other factors which are beyond the control of Besra Gold Inc. Actual results and developments may differ materially from those expressed or implied by these forward-looking statements depending upon a variety of factors. Nothing in this Announcement should be construed as either an offer to sell or a solicitation of an offer to buy or sell securities.

This Announcement has been prepared in accordance with the requirements of Australian securities laws and the requirements of the Australian Securities Exchange (ASX) and may not be released to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933 and may not be offered or sold in the United States except in transactions exempt from, or not subject to, registration under the US Securities Act and applicable US state securities laws.

Unless otherwise indicated, all mineral resource estimates and Exploration Targets included or incorporated by reference in this Announcement have been, and will be, prepared in accordance with the JORC classification system of the Australasian Institute of Mining and Metallurgy and Australian Institute of Geoscientists.

Disclosure

The Pejiru Sector lies within MC/KD/01/1994 which has been pending renewal for a number of years. As outlined in the Malaysian Solicitor’s Report on Title (Attachment G) of the Replacement Prospectus of Besra dated 8 July 2021, until a decision is made, the intention of section 48(9) of the Minerals Ordinance is to enable mining activities to continue on a pre-existing licence, in those prior lands of MC/KD/01/1994, until a determination of the renewal is made.

The information in this announcement is based on the following publicly available announcements previously lodged on the SEDAR PLUS

platform which are available on https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00001815. or on Besra’s website.

1 Besra Gold Inc Bau Gold Project Sarawak Malaysia Exploration Target Inventory. Lodged SEDAR Platform Feb 26, 2021.

2 Besra Bau Project – Mineral Resource and Ore Reserve Updated to JORC 2012 Compliance. Lodged SEDAR Platform Nov 22, 2018.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

APPENDIX A – Concessional Interests in the Bau Goldfield Corridor.