ASX ANNOUNCEMENT

31 October 2023

ASX: BEZ

HIGHLIGHTS

- Initial Payment of US$10 million received from Quantum in accordance with the Facility to fund the Bau Gold Project.

- Board appointments consolidate Quantum’s long term commitment.

- Bekajang follow-up drilling confirms ‘multi-storey’ gold endowment potential.

- Environmental Impact Assessment for future mining activities at Bekajang commenced.

- Development of Jugan pilot plant progressing.

- Exploration drilling commenced in Jugan area.

- Senior management changes implemented in anticipation of development phase.

The Board of Besra Gold Inc (ASX: BEZ) (“Besra” or the “Company”) is pleased to provide this Activities Report for the September 2023 Quarter, which accompanies the Quarterly Cash Flow Report.

Technical Activities

Bekajang Follow-Up Drilling Program

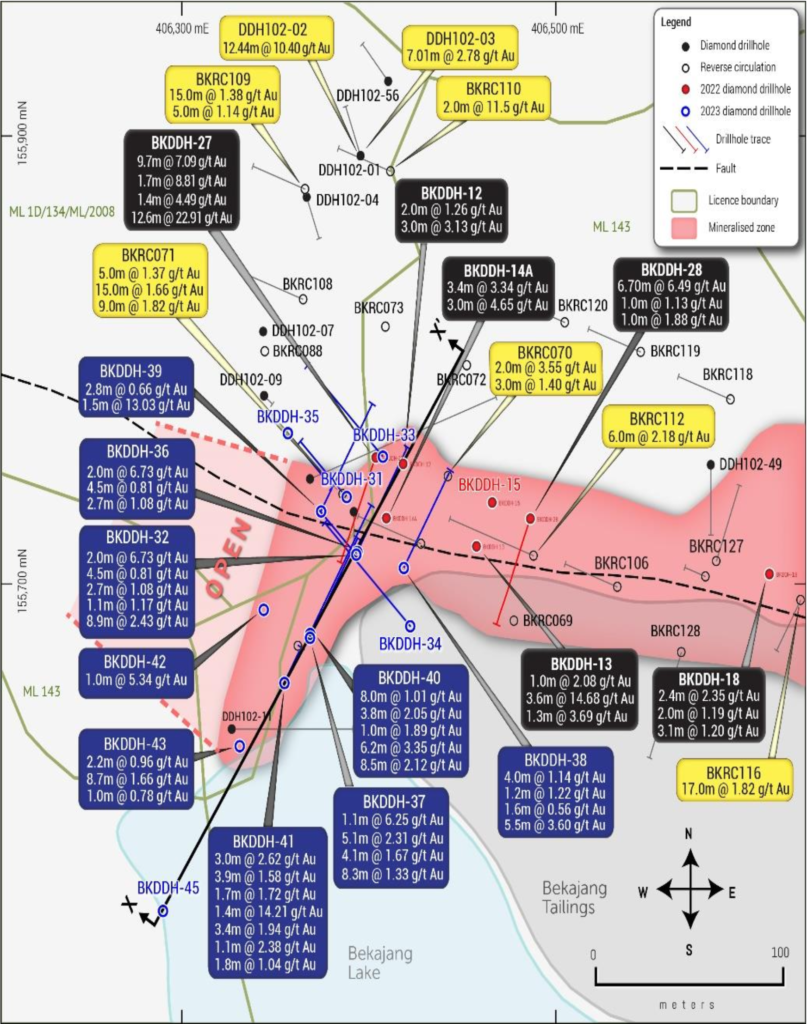

During the September 2023 Quarter, the results of a follow-up program of drilling (involving 14 fully cored drill holes BKDDH-31 to -43, 45, inclusive), were received and announced[1]. The locations of these follow-up drill holes are shown in Figure 1 and most notable assays of intercepted mineralised intervals are:

- BKDDH-32: 8.9m @ 2.43 g/t Au from 50.6 to 59.5m

- BKDDH-36: 1.0m @ 10.7 g/t Au from 40.7 to 41.7m & 1m @ 5.6 g/t Au from 45.3 to 46.3m

- BKDDH-37: 1.1m @ 6.25 g/t Au from 6.9 to 8m

- BKDDH-38: 5.5m @ 3.6 g/t Au from 15.0 to 20.5m

- BKDDH-39: 1.5m @ 13.03 g/t Au from 56.6 to 58.1m

- BKDDH-40: 6.2m @ 3.35 g/t Au from 40.7 to 46.9m & 8.5m @ 2.12 g/t Au from 49.8 to 58.3m

- BKDDH-41: 1.4m @ 14.21 g/t Au from 31.5 to 32.9m

- BKDDH-42: 1.0m @ 5.34 g/t Au from 14.8 to 15.8m

- BKDDH-43: 8.7m@1.66g/tAu from23to31.7m.

[1]ASX announcement 6 September 2023 “Bekajang drilling confirms ‘Multi-Storey’ gold endowment” & 7 September 2023 ‘Amended – drilling confirms Bekajang Multi-Storey Endowment’.

Figure 1 – Significant drillhole intercepts from Besra’s DDH 2022-2023 programs (black – first round, blue – follow-up round) superimposed onto historical Resource wireframe (in puce) along portion of the northern flank of the Bekajang tailings dam (Refer Figure X). Section XX’ is shown in Figures 2 & 3.

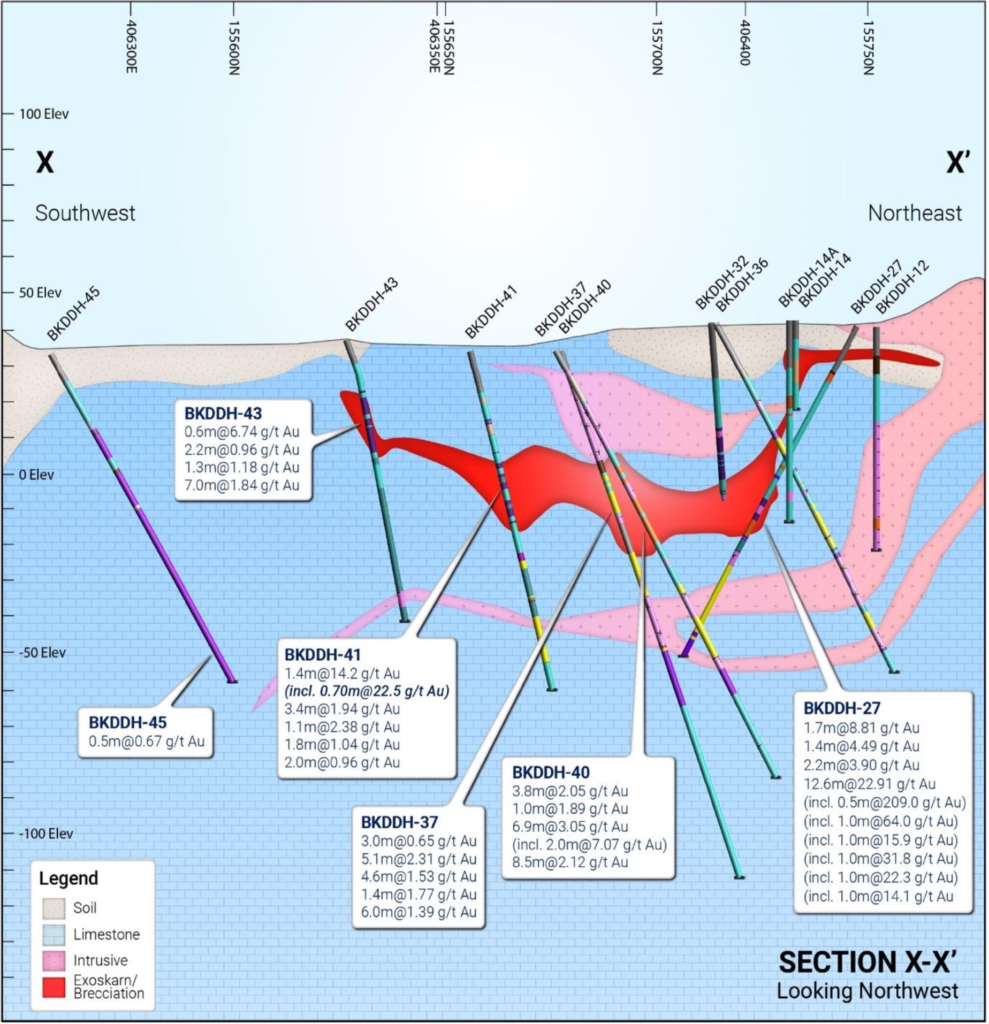

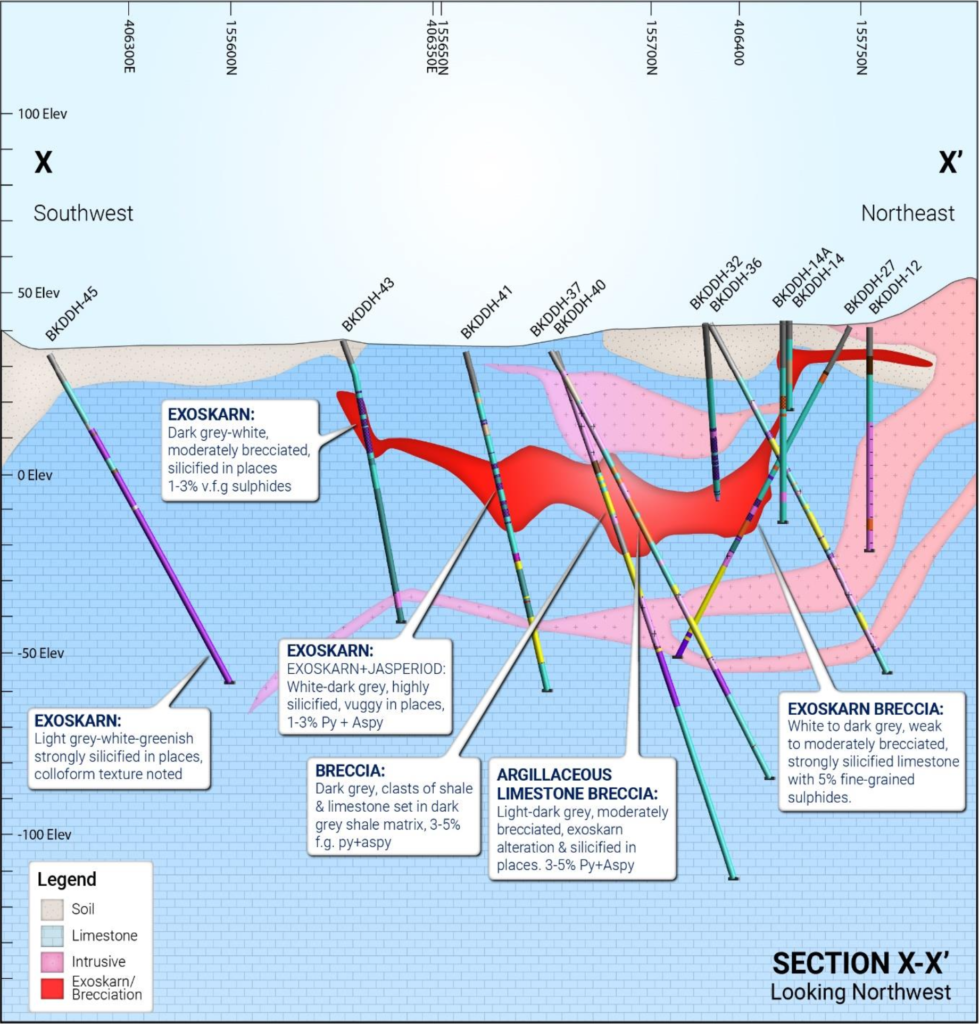

Designed to further investigate exceptional gold grades, intercepted within the underlying Bau Limestone over the interval 58.4m -71m of BKDDH-27 (ASX Release on 22 November 2022[2]), follow-up drill holes BKDDH-37, BKDDH- 40, BKDDH-41, BKDDH-42 and BKDDH-43 intersected extensions of the BKDDH-27 discovery interval. Figures 2 & 3 illustrate that this interval appears to be strata-bound, typically, within a depth range of 30m-60m sub-surface and not, as originally thought, steeply dipping. Variations in its interpreted thickness are attributed to proximity to both faulting and intrusives. Importantly, the new drilling evidences the relationship between the higher grades of gold endowment within the Bau Limestone, with exoskarn and hydrothermal breccia textures which appear bestdeveloped along the margins of altered porphyry intrusions or associated with faulting. The highest gold grades within these alteration textures are associated with subsequent silicification.

Figure 2 – Summary of significant intercepts, highlighting the correlation of the discovery interval in BKDDH-27 with assay results from the follow-up round holes (red interval) projected onto cross- section XX’ – Refer Figure 1.

[2]Exceptional High & Bonanza Grade Gold Intercepts Upgrade Bekajang’s Potential. Besra ASX Release 22 Nov 2022.

In separate studies undertaken for Besra, this alteration is shown to be enriched in Au, Tl, As, Sb, Ag, S and base metals (including Cu Pb and Zn), when compared to the shallower limestone-shale contact mineralisation,

Figure 3 – Summary of hydrothermal alteration textures used to provide a signature marker for correlating extensions of the BKDDH-27 discovery interval with intercepts from the follow-up round holes (red interval) projected onto cross-section XX – Refer Figure 1.

supporting the view that it is located more proximal to the originating source. This indicates that mineralisation of the discovery interval of BKDDH-27 is located deeper in standard metal zoning models and the presence of the rareoccurrence of free gold in that drill hole which raises the possibility that this portion of the Bekajang system may have further free gold potential, especially where associated with former feeder systems.

The follow-up drill results also continued to confirm the continuity and tenor of gold mineralisation within the overlying LSC. BKDDH-37, -38, -41 and -42 each encountered significant grades of up to 6.25g/t Au, at near shallow depths (<20m), where the Pedawan Shale or “Z” horizon is developed.

Bekajang Environmental Impact Assessment

Chemsain Konsultant Sdn Bhd, of Kuching, has been engaged to undertake an Environmental Impact Assessment (EIA) of Bekajang as part of a process to enable Besra to commence mining activities. Initially the intention is to excavate representative bulk samples and conduct processing studies at Besra’s Jugan Pilot Plant. For these purposes the Bekajang site will consist of a test pit, which is being designed by Snowden Optiro, with excavation, stockpile and uploading facilities for transporting bulk samples to the Jugan Pilot Plant, located some 7km away.

Jugan Activities

- Jugan Pilot Plant Activities

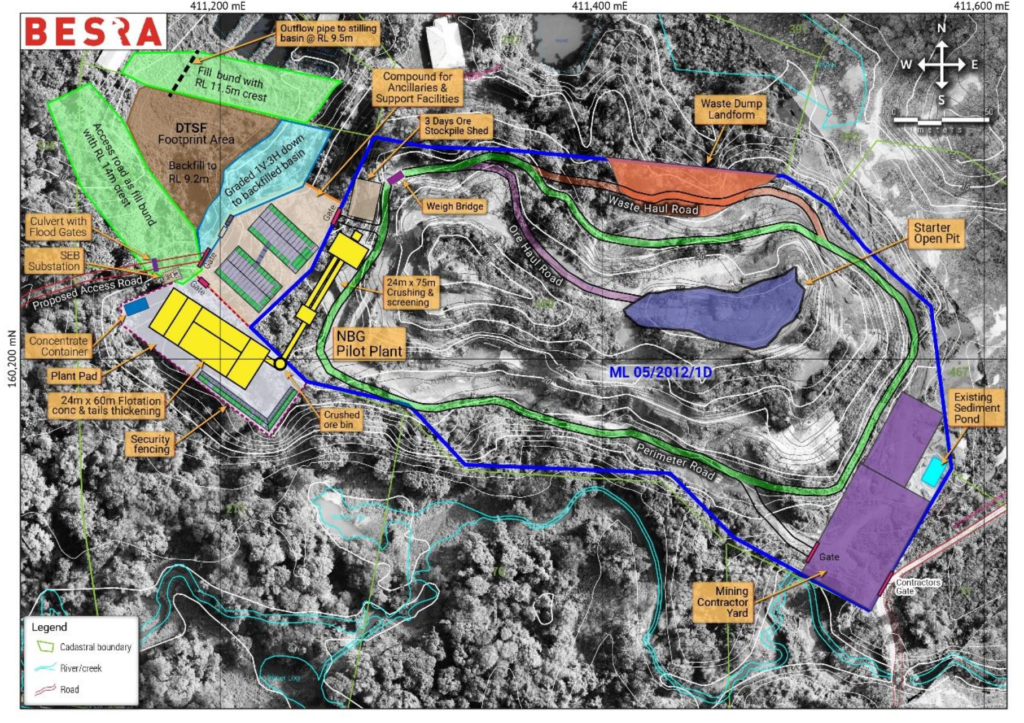

During the September 2023 Quarter, activities associated with the construction and commissioning of the Jugan Pilot Plant continued. A major contract, for the provision of the pilot plant processing equipment was let to Yantai- Jenping Machinery Co of China. The contract provides for the supply, construction, commissioning and training of personnel on site and involves a total cost of ~US$1.2 million. Project Manager KTA, one of Malaysia’s top ten engineering groups and the largest in Sarawak, is assisting in ensuring that all imported equipment meets local jurisdiction, HSE and other regulatory specifications.

Site specific civil earthworks, housing of the processing equipment and habitable compound, connection of utilities, tailings, stockpile and ancillary facilities, together with the processing equipment costs are budgeted for US$3.9 million. The planned site layout is shown in Figure 4. The design is based on an initial nominal capacity of 50 tonnes per day. The pilot plant will trial various batch processing combinations in order to develop optimal protocols for processing the Jugan refractory ore to a concentrate for further processing of a dore. As such, these trial results will form an important component of the overall Final Feasibility Study for future commercialisation.

Other pilot plant related activities conducted during the Quarter included:

- Detailed high resolution topographical surveying for civil earthworks and drainage management;

- Baseline site soil and water sampling by Envisar Sdn Bhd;

- Flora site survey and preparation of management plan;

- Fauna site survey and preparation of management plan;

- Sedimentation and Erosion Control Management Planning by Ambiente Hajau Sdn Bhd, Kuching;

- Tailings storage facilities design by TailsCon Projects, Perth Western Australia;

- Pit Design and layout review – Snowden Optiro, Perth Western Australia;

- Sterilisation drilling.

The purpose of the sterilisation drilling is to ensure that the proposed pilot plant infrastructure will not sterilise access to potential commercial mineralisation at a later date.

Besra also shipped a significant bulk sample of representative “run-of-mine” feed from Jugan to a third party for trial processing. This will be completed before 31 December 2023 and will satisfy the requirements for production of gold concentrate from the “Initial Project”, as required in accordance with the Funding Agreement with Quantum.

Figure 4 – Proposed Jugan Pilot Plant site design, superimposed onto topography & grey-scale Landsat imagery.

- Drilling Activities

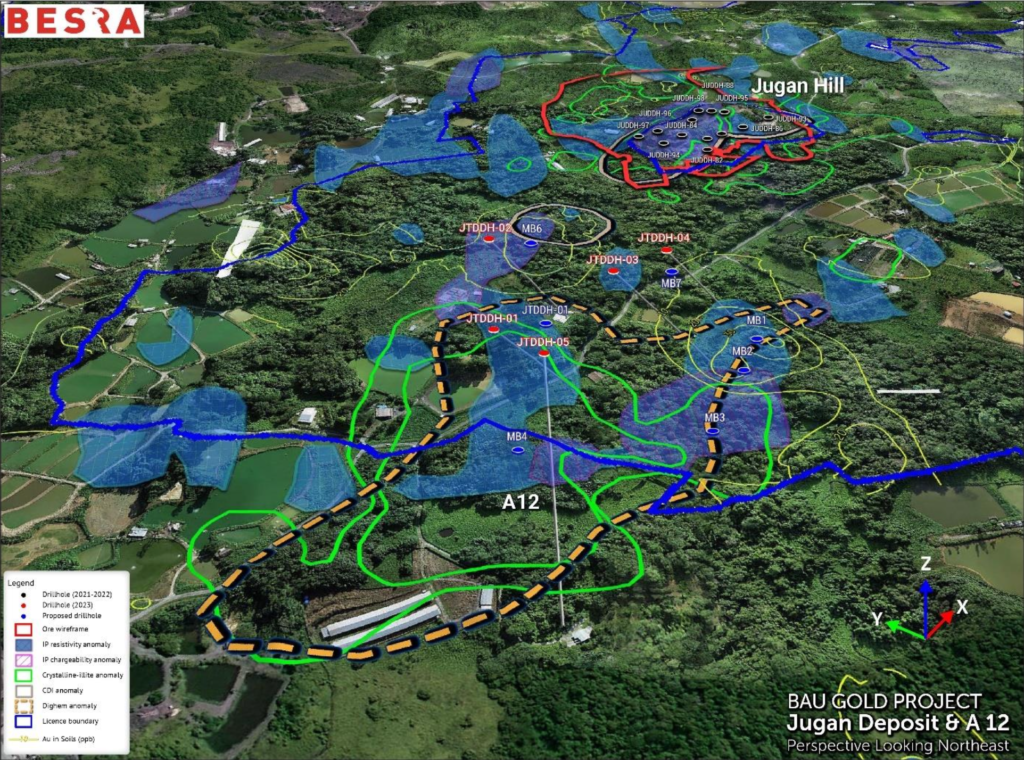

During the September 2023 Quarter, in addition to limited sterilisation drilling, reconnaissance drilling commenced in areas surrounding Jugan, targeting geological and geophysical anomalies including those within the anomaly area known as A12 (Figure 5). Drill holes JTDDH-101 to -104 have been completed and core samples sent for assay. Although final assay results have not been received, visual inspection of the core confirms that the geology and associated mineralisation display much greater variability than at the nearby Jugan Prospect. This is consistent with a more defocused distribution of anomalies, compared to the signature across the Jugan Prospect. Initial indications are that there appears to be a greater association with intrusives and fault related brecciation than at Jugan. Likewise, the sulphide mineralisation appears finer grained and disseminated, pyrite being more dominant than arsenopyrite.

This drilling is expected to shed light on what are the main rock attributes which are associated with the variously coincident geophysical conductivity and resistivity anomalies, as well as controls on the surface expression of numerous surface geochemical anomalies.

Figure 5 – Geophysical and geological anomalies in the area surrounding Jugan Prospect together with the locations of JTDDH-101 to 105.

BACKGROUND TO BAU GOLD PROJECT

The Bau Gold Project is located 30km – 40km from Kuching, the capital city of the State of Sarawak, Malaysia, on the island of Borneo (Figure 4) and centred on the township of Bau (Figure 7).

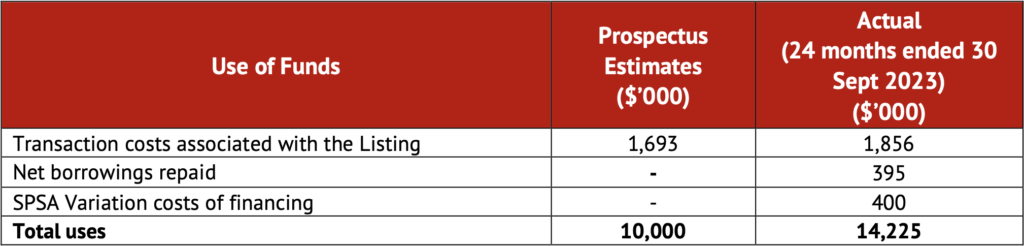

Besra controls, directly and indirectly, a 97.8% interest (92.8% on an equity adjusted basis) of the Bau Gold Project. This project lies at the western end of an arcuate metalliferous belt extending through the island of Borneo. In Kalimantan, the Indonesian jurisdiction portion of Borneo Island, this belt is associated with significant gold mining areas including Kelian (7 Moz) and Mt Muro (3 Moz).

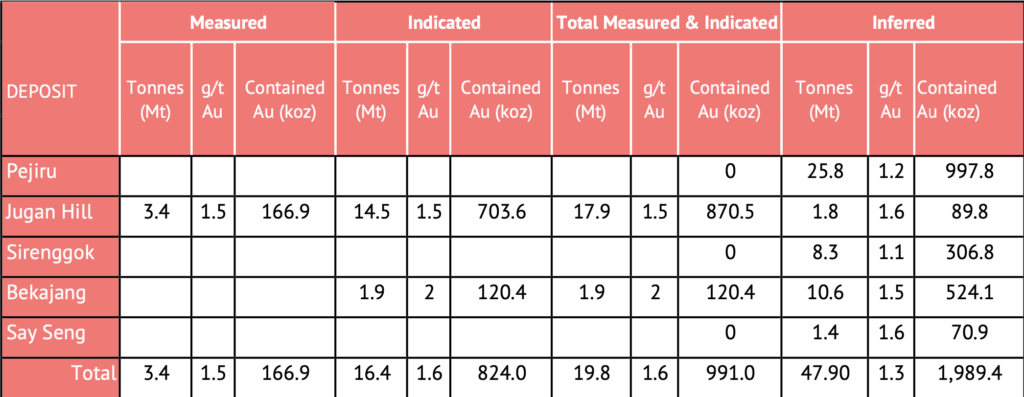

The Bau Gold Project is defined by a gold bearing mineralisation system covering approximately an 8km x 15km corridor. Within this corridor Besra has identified JORC (2012) Resources across a number of discrete deposits of Measured 3.4 Mt @ 1.5g/t Au for 166.9koz, indicated 16.4 Mt @ 1.57g/t Au for 824.8 koz and Inferred 47.9 Mt @ 1.29 g/t Au for 1,989 koz. In addition, the Project has a global Exploration Target ranging between 4.9 Moz and 9.3 Moz[3],[4] (on a 100% basis). The region is well serviced by infrastructure including ready access to deep water ports, international airport, grid power, communications and a multitude of service providers.

[3]Refer Prospectus dated 8 July 2021, Section 3.11 and Attachment G.”

[4]Jugan Exploration Target ranges between 2.0 – 3.2 Mil Oz Au based on a range of grades of 1.82 – 2.50 g/t Au. The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

Figure 6 – Location of Bau Gold Project. Inset shows tenement interests within Sarawak and location of metalliferous belt traversing the island of Borneo (in red).

Mineral licences in which the Company has an interest are shown in Appendix A.

Table 1– JORC 2012 Compliant Resources for the Bau Gold Field Project[5].

[5]Updated to include an impairment following the expiry of Ex-ML 136, as announced to the ASX on 20 January 2023.

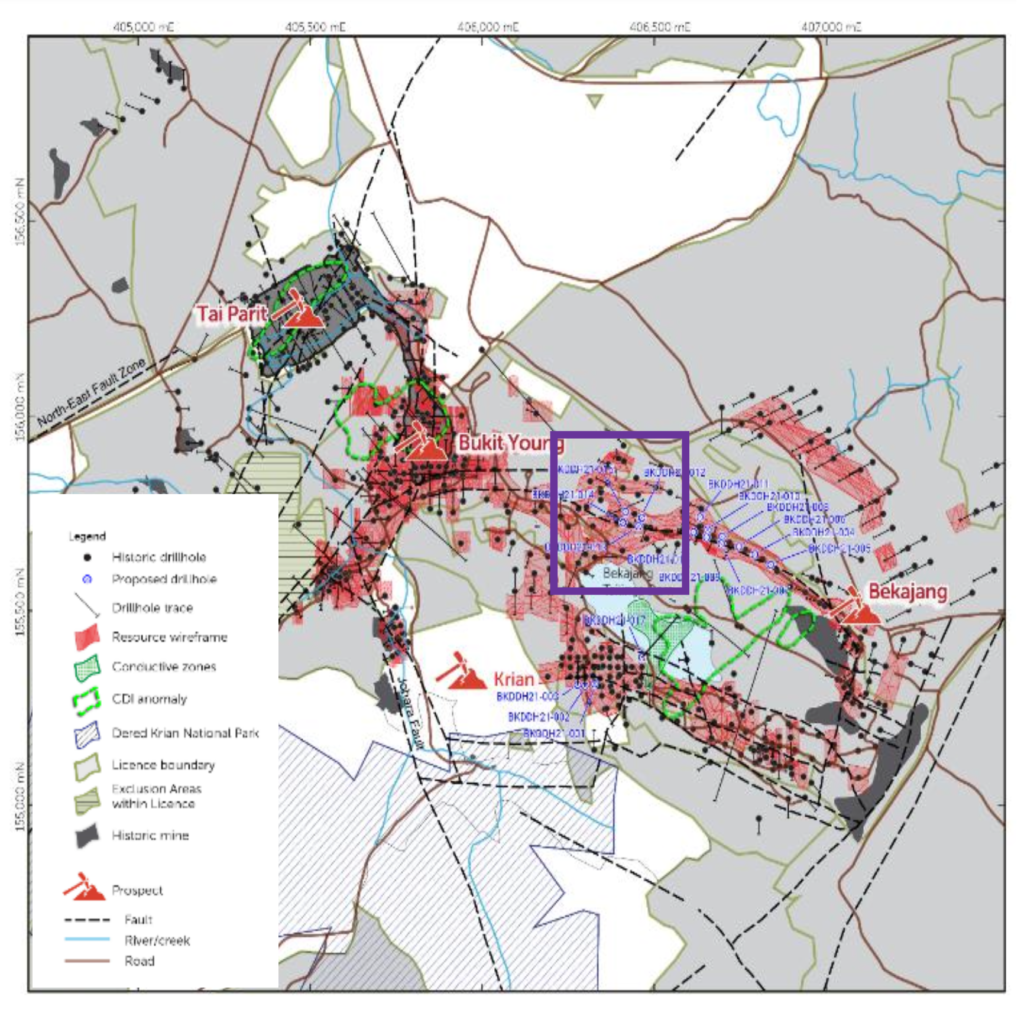

Figure 7: Location of the Bekajang Sector (highlighted within red box) south Bau township in the centre of the Bau Gold Field corridor and adjacent to the most recent commercial mine Tai Parit.

Bekajang Project

The Bekajang Project (Figures 7 & 8) lies along a very prospective trend that includes two historical mine sites (Figure 2). The Bukit Young Gold pit was mined until September 1992, prior to the redevelopment of Tai Parit that, according to mine records, produced some 440,926 tonnes at a grade of 4.51 g/t Au. Tai Parit recorded production of some 700,000 oz of gold, of which approximately 213,000 oz @ 7 g/t was produced between 1991 and 1997 by Bukit Young Gold Mine Sdn Bhd, the last commercial operator within the Bau Gold Field corridor.

Historical drilling provides the basis for a substantial JORC 2012 compliant Resource inventory at Bekajang, comprising:

- A Measured and Indicated Resource* totalling 120.4 koz @ 2.0 g/t Au;

- An Inferred Resource *of 524 koz @ 1.5 g/t Au; and

- An additional Exploration Target** of 0.50 – 0.80 Moz @ 2.0 – 3.0 g/t Au, respectively.

* In accordance with ASX listing Rules 5.23 and 5.16.5 by inserting specific reference to the following: Besra is not aware of any new information or data that materially affects, in the case of estimates of a Mineral Resource, the material assumptions and technical parameters underpinning its stated Mineral Resource inventory estimates and their related material assumptions and technical parameters continue to apply and have not been materially changed; and The potential quantity and grade of an Exploration Target is conceptual in nature, there has been insufficient exploration to determine a Mineral Resource and there is no certainty that further exploration work will result in the determination of Mineral Resources or that the production target itself will be realised.

**The potential quantity and grade of an Exploration Target is conceptual in nature, there has been insufficient exploration to determine a Mineral Resource and there is no certainty that further exploration work will result in the determination of Mineral Resources or that the production target itself will be realised.

Figure 8: Location of the prospective Bekajang – Bukit Young – Tai Parit trend showing Resource wireframes (in puce) and Besra’s 2022-2023 Bekajang diamond drilling program (blue annotation). Dashed green outline represents interpreted footprint of intrusive body situated at depth beneath the Bekajang tailings dam, based on DIGHEM anomalies. Details contained within the purple rectangle are further illustrated in Figure 1.

Jugan Project

The Jugan Project is located approximately 6km NE of the Bau township (Figure 2). Contained within the Pedawan Formation, the mineralisation is shallowest across a local topographic high – Jugan Hill.

Previous drilling has formed the basis of the current JORC Resource at Jugan which comprises:

- Measured + Indicated Resource of 870,000 Oz1 at 1.5 g/t Au;

- Inferred Resource of 90,000 Oz1 at 1.6 g/t Au; and

- Additional Exploration Target[6],[7] of 2.0 – 3.2 Moz at 1.8 – 2.5 g/t Au.

Previous drilling also revealed the bulk of mineralisation to be confined to a thrust sheet bound between two thrust faults, the hanging and footwall thrusts, vertically separated by between 40m – 100m. Towards the northeast, the thrust bound mineralisation rolls over to form a steeply plunging limb. It remains open at depth.

Corporate

Corporate activities during the September 2023 Quarter were dominated by shareholder approval of the Quantum Facility and reorganisation of the Board, including the appointment of two Quantum representatives.

Specifically, the main corporate activities were:

- 25 July 2023, Besra’s shareholders approved the Gold Purchase Agreement (GPA) in which Quantumis to provide a US$300,000,000 gold offtake drawdown facility (Facility);

- 26 July 2023, Besra received US$5,000,000 ‘Initial Payment’, from Quantum pursuant to the GPAfollowing the approval by shareholders of the Facility at a Special General Meeting of shareholders;

- 2 August 2023, resignation of Ms Jocelyn Bennett as Chair and director of the Company;

- 7 September 2023, drilling confirms the presence of multi-storey mineralisation at Bekajang;

- 20 September 2023, satisfaction of all GPA conditions precedent;

- 27 September 2023, Paul Ingram resigned as a director;

- 27 September 2023 appointment of Quantum nominees, Dato’ Lim Khong Soon as Executive Chair (on a non-fulltime basis) and Mr Chang Loong Lee as a Non-Executive Director of the Company, effective immediately

Subsequent Events

- 3 October 2023, announcement of the termination of an agreement with Pangaea Resources Limited to acquire 1,802 shares in North Borneo Gold Sdn Bhd shares.

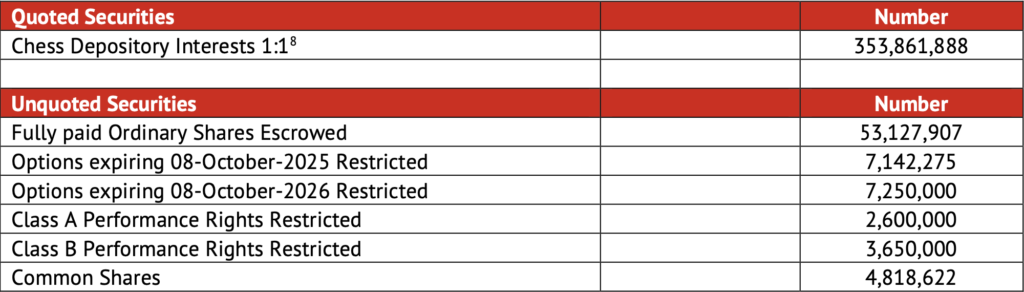

- 10 October 2023, the Company sought application for quotation of 53,127,907 CDI securities following the expiry of a 2 year escrow period. This increased the total number of CDI securities quoted on the ASX to 418,100,906.

- 11 October 2023, the Company announced the receipt of US$10 million from Quantum in accordance with the Facility.

[6]Jugan Exploration Target ranges between 4.9 Moz – 9.3 Moz based on a range of grades of 1.82 – 2.50 Au g/t.

[7]The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

Table 2 – Capital structure as at 30 September 2023.

Additional ASX Listing Rule Disclosures

ASX Listing Rule 5.3.1 – Payments for direct exploration expenditure during the September 2023 Quarter totalled $1,270k (YTD $1,270k.) Details of the exploration activities undertaken during the June 2023 Quarter are as noted in this Activities Report.

ASX Listing Rule 5.3.2 – The Company has not yet commenced mining production and development activities.

ASX Listing Rule 5.3.3 – There were no changes to Besra’s interests in the Bau Gold Project.

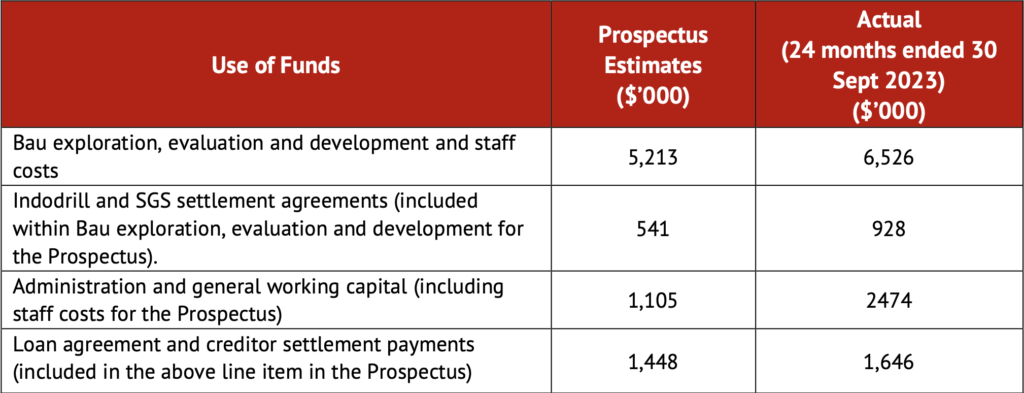

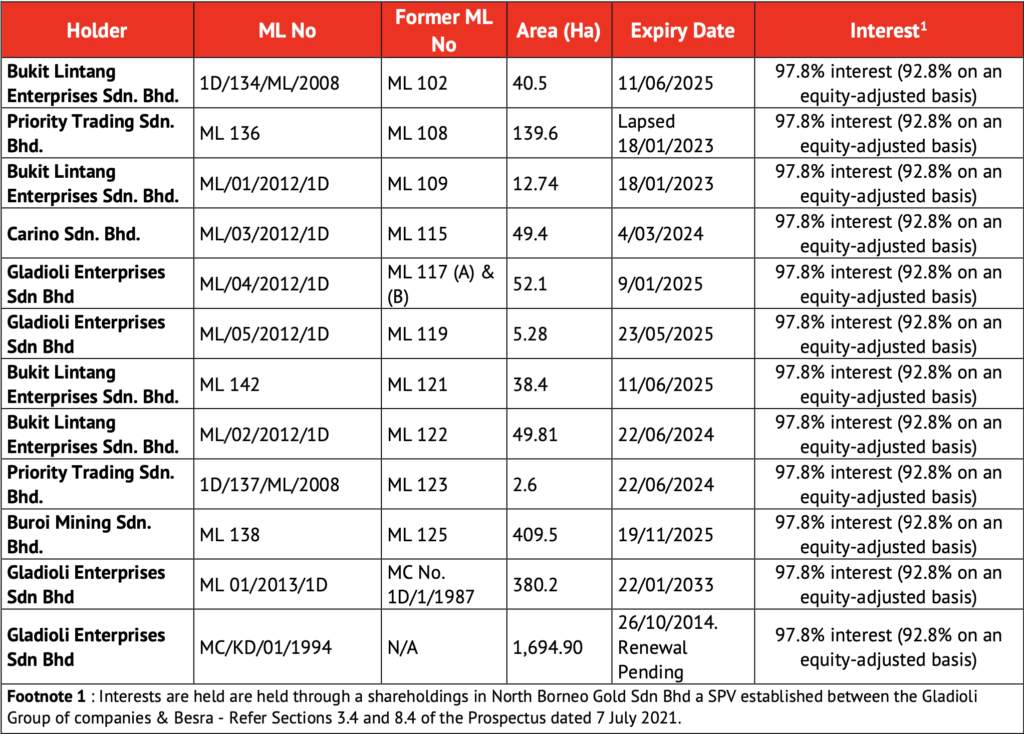

ASX Listing Rule 5.3.4 – Besra was admitted to the official list of the ASX on 8 October 2021 following completion of an IPO raising. The September 2023 Quarter is included in a period covered by the use of funds statement in the IPO prospectus lodged with ASX under Listing Rule 1.1 condition 3.

A comparison of the Company’s actual expenditure up to September 30, 2023 on the individual items in the “use of funds” statement since the date of its admission to the official list against the estimated expenditure on those items in the “use of funds” statement in the Company’s prospectus is set out below, as required by ASX Listing Rule 4.7C.2.[9]

Table 3 – Comparison of actual expenditure to date.

[8]Note subsequent events and the lifting of escrow conditions on 53,127,907 CDI securities on 10 October 2023.

[9]Forecast expenditure classifications used in the Prospectus may differ from the classifications used in the Appendix 5B.

The Company notes:

- New capital was received within the first year since admission to expedite the Bau Project, following the positive results from the planned 2022 drilling programs. In October 2022, $1,000,000 was raised from a placement with the Company’s Substantial Shareholder, Quantum Metals Recovery Inc (“Placement”);

- Following the receipt of the Placement funds, and completion of an Entitlement Offer on 3 January 2023 Besra’s operations accelerated;

- Activities at the Bau Project continued during the September 2023 Quarter focused on the Bekajang and Jugan Projects. This included forward drilling proposals within the Bekajang Project and on-going design and preparatory and letting of contracts for construction and commissioning of a test pit and pilot plant at Jugan.

ASX Listing Rule 5.3.5 – payments to related parties during the Quarter as outlined in sections 6.1 and 6.2 of the Appendix 5B consisted of the following:

- Non-executive director fees included staff costs for services provided during the quarter totalled $73k are included in 1.2(d) of the attached Appendix 5B;

- Executive director fees for services provided during the quarter and capitalised to exploration and evaluation costs amounted to $179k are included in 2.1(d) of the attached Appendix 5B.

This announcement has been approved by the Board of Besra.

For further information:

| Australasia | North America |

|

John Seton Executive Director Email: john@besra.com |

James Hamilton Investor Relations Services Mobile: +1 416 471 4494 Email: jim@besra.com |

Competent Person’s Statement

The information in this Announcement that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr. Kevin J. Wright, a Competent Person who is a Fellow of the Institute of Materials, Minerals and Mining (FIMMM), a Chartered Engineer (C.Eng), and a Chartered Environmentalist (C.Env). Mr. Wright is a consultant to Besra. Mr. Wright has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code (2012 Edition) of the Australasian Code for Reporting of Exploration Results, and a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

Kevin J. Wright consents to the inclusion in this Announcement of the matters based on his information in the form and context that it appears.

Disclaimer

This Announcement contains certain forward-looking statements and forecasts concerning future activities, including potential delineation of resources. Such statements are not a guarantee of future performance and involve unknown risks and uncertainties, as well as other factors which are beyond the control of Besra Gold Inc. Actual results and developments may differ materially from those expressed or implied by these forward-looking statements depending upon a variety of factors. Nothing in this Announcement should be construed as either an offer to sell or a solicitation of an offer to buy or sell securities.

This Announcement has been prepared in accordance with the requirements of Australian securities laws and the requirements of the Australian Securities Exchange (ASX) and may not be released to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933 and may not be offered or sold in the United States except in transactions exempt from, or not subject to, registration under the US Securities Act and applicable US state securities laws.

Unless otherwise indicated, all mineral resource estimates and Exploration Targets included or incorporated by reference in this Announcement have been, and will be, prepared in accordance with the JORC classification system of the Australasian Institute of Mining and Metallurgy and Australian Institute of Geoscientists.

Disclosure

The Pejiru Sector lies within MC/KD/01/1994 which has been pending renewal for a number of years. As outlined in the Malaysian Solicitor’s Report on Title (Attachment G) of the Replacement Prospectus of Besra dated 8 July 2021, until a decision is made, the intention of section 48(9) of the Minerals Ordinance is to enable mining activities to continue on a pre-existing licence, in those prior lands of MC/KD/01/1994, until a determination of the renewal is made.

The information in this announcement is based on the following publicly available announcements previously lodged on the SEDAR

platform which are available on https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00001815. or on Besra’s website.

1) Besra Gold Inc Bau Gold Project Sarawak Malaysia Exploration Target Inventory. Lodged SEDAR Platform Feb 26, 2021.

2) Besra Bau Project – Mineral Resource and Ore Reserve Updated to JORC 2012 Compliance. Lodged SEDAR Platform Nov 22, 2018.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

APPENDIX A – Concessional Interests in the Bau Goldfield Corridor.